DEF 14A: Definitive proxy statements

Published on April 29, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a‑12

|

Trevena, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on tablein exhibit required by Item 23(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

April 29, 2024

955 Chesterbrook Boulevard, Suite 110

Chesterbrook, PA 19087

Dear Trevena Stockholder:

On behalf of the Trevena, Inc. Board of Directors and our senior management team, we are pleased to invite you to our 2024 Annual Meeting of Stockholders (the “Annual Meeting”) on June 13, 2024. The Annual Meeting will be a virtual stockholder

meeting through which you can listen to the meeting, submit questions and vote online if you have not voted prior to the meeting. The attached Notice of 2024 Annual Meeting of Stockholders and proxy statement contain important information about the

business to be conducted at the Annual Meeting.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. Please review the instructions on each of your voting options described in the Important Notice Regarding the

Availability of Proxy Materials. Additional instructions on how to vote can be found on pages 2 through 6 of the proxy statement.

We hope that you can attend the Annual Meeting. As always, thank you for your continued support of Trevena.

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

Carrie L. Bourdow

|

|

|

President and Chief Executive Officer

|

|

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

|

|

Date and Time:

|

Thursday, June 13, 2024 at 8:30 a.m. Eastern Time

|

|

Place:

|

The Annual Meeting will be held virtually at the following website: http://www.virtualshareholdermeeting.com/TRVN2024, and can be accessed by entering the 16-digit control number included on the proxy card mailed to you.

|

|

Items of Business:

|

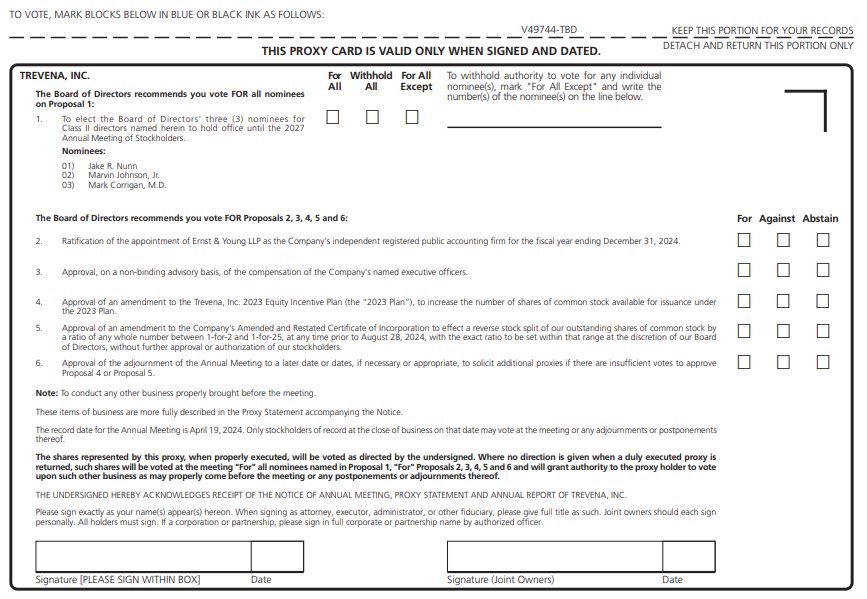

Proposal 1: Election of the three director nominees named in the proxy statement for terms expiring at the 2027 Annual Meeting of Stockholders.

Proposal 2: Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

Proposal 3: Approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers.

Proposal 4: Approval of an amendment to the Trevena, Inc. 2023 Equity Incentive Plan (the “2023 Plan”), to increase the number of shares of common stock available for issuance under the

2023 Plan.

Proposal 5: Approval of an amendment to our Amended and Restated Certificate of Incorporation (as amended, the “Restated Certificate”) to effect a reverse

stock split of our outstanding shares of common stock by a ratio of any whole number between 1-for-2 and 1-for-25 (the “Reverse Stock Split”), at any time prior to August 28, 2024, with the exact ratio to be set within that range at the

discretion of our Board of Directors, without further approval or authorization of our stockholders.

Proposal 6: Approval of the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are

insufficient votes to approve Proposal 4 or Proposal 5.

Consideration of any other business properly brought before the Annual Meeting or any adjournments thereof.

|

|

Record Date:

|

April 19, 2024. Only Trevena stockholders of record at the close of business on the record date are entitled to receive this notice and vote at the Annual Meeting and any adjournment or postponement of the Annual Meeting.

A list of stockholders of the Company entitled to vote at the Annual Meeting will be available for inspection by any stockholder of record upon request during the 10-day period immediately prior to the date of the Annual Meeting. The

list will be available during the Annual Meeting for inspection by stockholders of record for any legally valid purpose related to the Annual Meeting at http://www.virtualshareholdermeeting.com/TRVN2024.

|

|

Proxy Voting:

|

Your vote is very important, regardless of the number of shares you own. We urge you to promptly vote by telephone, by using the Internet, or, if you received a proxy card or instruction form, by completing, dating, signing and returning

it by mail. For instructions on voting, please see Questions and Answers about the Annual Meeting and Voting beginning on page 2.

|

| April 29, 2024 |

By order of the Board of Directors, | |

|

|

|

|

|

|

|

Joel Solomon

|

|

|

|

Corporate Secretary

|

|

EACH STOCKHOLDER IS URGED TO VOTE BY COMPLETING, SIGNING AND RETURNING

THE PROXY CARD IN THE ENVELOPE PROVIDED OR BY VOTING VIA THE INTERNET OR BY TELEPHONE, IN EACH CASE IN THE MANNER DESCRIBED IN THE NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS. IF A STOCKHOLDER DECIDES TO VIRTUALLY ATTEND THE ANNUAL MEETING, HE OR SHE MAY, IF SO DESIRED, REVOKE THE PROXY AND VOTE THE SHARES OVER THE INTERNET DURING THE ANNUAL MEETING. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL STOCKHOLDER MEETING TO BE HELD ON JUNE 13, 2024

Our 2024 Notice of Annual Meeting and Proxy Statement and 2023 Annual Report to Stockholders are available at www.proxyvote.com.

Please see “Information About the 2024 Annual Meeting” beginning on page 1 of this proxy statement for the following information:

|

•

|

Date and time of the 2024 Annual Meeting of Stockholders (the “Annual Meeting”);

|

|

•

|

How to access the virtual Annual Meeting;

|

|

•

|

How to vote via the internet during the Annual Meeting if you have not voted prior to the meeting;

|

|

•

|

An identification of each separate matter to be acted on at the Annual Meeting; and

|

|

•

|

The recommendations of our Board of Directors regarding those matters.

|

|

TABLE OF CONTENTS

|

|

INFORMATION ABOUT THE 2024 ANNUAL MEETING

|

1

|

|

Questions and Answers About the Proxy Materials

|

1

|

|

Questions and Answers About the Annual Meeting and Voting

|

2

|

|

CORPORATE GOVERNANCE

|

7

|

|

Governance Policies and Practices

|

7

|

|

Role of the Board and Leadership Structure

|

8

|

|

Other Board Practices

|

9

|

|

Board Meetings and Committees

|

11

|

|

Director Independence

|

13

|

|

Code of Ethics

|

14

|

|

Certain Transactions

|

14

|

|

PROPOSAL 1. ELECTION OF DIRECTORS

|

16

|

|

Process for Selecting and Nominating Directors

|

16

|

|

Class II Directors Nominated by the Board of Directors For Election at 2024 Annual Meeting

|

18

|

|

Class III Directors Who Will Continue in Office Until the 2025 Annual Meeting

|

20

|

|

Class I Directors Who Will Continue in Office Until the 2026 Annual Meeting

|

21 |

|

NON-EMPLOYEE DIRECTOR COMPENSATION

|

23

|

|

Overview

|

23

|

|

Director Compensation Program

|

23

|

|

Director Compensation Table for 2023

|

24

|

|

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

25

|

|

REPORT OF THE AUDIT COMMITTEE

|

27

|

|

PROPOSAL 3. APPROVAL ON A NON-BINDING ADVISORY BASIS OF COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS (“SAY ON PAY”)

|

28

|

|

PROPOSAL 4. APPROVAL OF AN AMEDMENT TO THE TREVENA, INC. 2023 EQUITY INCENTIVE PLAN (THE “2023 PLAN”) TO INCREASE THE NUMBER OF SHARES OF

COMMON STOCK AVAILABLE FOR ISSUANCE UNDER THE 2023 PLAN

|

30

|

|

PROPOSAL 5. APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION (AS AMENDED, THE “RESTATED

CERTIFICATE”) TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK BY A RATIO OF ANY WHOLE NUMBER BETWEEN 1-FOR-2 AND 1-FOR-25 (THE “REVERSE STOCK SPLIT”), AT ANY TIME PRIOR TO AUGUST 28, 2024, WITH THE EXACT RATIO TO

BE SET WITHIN THAT RANGE AT THE DISCRETION OF OUR BOARD OF DIRECTORS, WITHOUT FURTHER APPROVAL OR AUTHORIZATION OF OUR STOCKHOLDERS.

|

38

|

|

PROPOSAL 6. APPROVAL OF THE ADJOURNMENT OF THE ANNUAL MEETING TO A LATER DATE OR DATES, IF NECESSARY OR APPROPRIATE, TO

SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES TO ADOPT PROPOSAL 4 OR PROPOSAL 5.

|

46

|

|

TABLE OF CONTENTS (CONTINUED)

|

|

EXECUTIVE COMPENSATION

|

47

|

|

Overview

|

47

|

|

2023 Summary Compensation Table

|

51

|

|

Narrative to 2023 Summary Compensation Table

|

52

|

|

Outstanding Equity Awards at Year-End 2023

|

57

|

|

Executive Officer Agreements

|

59

|

|

OWNERSHIP OF TREVENA COMMON STOCK

|

64

|

|

Security Ownership of Certain Beneficial Owners, Directors and Executive Officers

|

64

|

|

2025 ANNUAL MEETING AND RELATED MATTERS

|

65

|

|

INFORMATION ABOUT THE 2024 ANNUAL MEETING

|

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

Why did I receive proxy materials? What is included in the proxy materials?

Our Board of Directors (the “Board”) is soliciting your proxy to vote at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). You received proxy materials because you owned shares of Trevena common stock at the close of business on

April 19, 2024, the record date, and that entitles you to vote at the Annual Meeting.

Proxy materials include the notice of annual meeting of stockholders, the proxy statement and our annual report on Form 10-K for the year ended December 31, 2023 and, if you received paper copies, a proxy card or voting instruction form. The

proxy statement describes the matters on which the Board would like you to vote, and provides information about Trevena that we must disclose under Securities and Exchange Commission (SEC) regulations when we solicit your proxy.

Your proxy will authorize specified persons, each of whom also is referred to as a proxy, to vote on your behalf at the Annual Meeting. By use of a proxy, you can vote whether or not you attend the Annual Meeting via the internet. The written

document by which you authorize a proxy to vote on your behalf is referred to as a proxy card.

We intend to mail these proxy materials on or about April 29, 2024 to all stockholders of record entitled to vote at the Annual Meeting.

How can I get electronic access to the proxy materials?

The proxy materials are available for viewing at www.proxyvote.com. On this website, you may:

|

|

• |

vote your shares after you have viewed the proxy materials; and

|

|

|

• |

select a future delivery preference of paper or electronic copies of the proxy materials.

|

You may choose to receive proxy materials electronically in the future. If you choose to do so, you will receive an email with instructions containing an electronic link to the proxy materials for next year’s annual meeting. You also will

receive an electronic link to the proxy voting site.

Rules adopted by the SEC allow companies to send stockholders a notice of Internet availability of proxy materials only, rather than mail them full sets of proxy materials. This year, we chose to mail full packages

of proxy materials to stockholders. However, in the future we may take advantage of this alternative “notice only” distribution option. If in the future we choose to send only such notices, they would contain instructions on how stockholders can

access our notice of annual meeting and proxy statement via the Internet. It also would contain instructions on how stockholders could request to receive their materials electronically or in printed form on a one-time or ongoing basis.

If you hold your shares through a bank, broker or other custodian, you also may have the opportunity to receive the proxy materials electronically. Please check the information contained in the documents provided to you by your bank, broker or

other custodian.

|

We encourage you to take advantage of the availability of the proxy materials electronically to help reduce the environmental impact of the Annual Meeting.

|

1

|

INFORMATION ABOUT THE 2024 ANNUAL MEETING (CONTINUED)

|

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What am I voting on at the Annual Meeting?

|

Proposal

|

Description

|

Board’s Vote Recommendation

|

Page

|

|

|

1

|

Election of the three director nominees named in this proxy statement for terms expiring at the 2027 Annual Meeting of Stockholders

|

Vote FOR each of the nominees

|

16

|

|

|

2

|

Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024

|

Vote FOR

|

25

|

|

|

3

|

Approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers

|

Vote FOR

|

28

|

|

|

4

|

Approval of an amendment to the Trevena, Inc. 2023 Equity Incentive Plan (the “2023 Plan”), to increase the number of shares of common stock available for issuance under the 2023 Plan

|

Vote FOR

|

30

|

|

|

5

|

Approval of an amendment to our Amended and Restated Certificate of Incorporation (as amended, the “Restated Certificate”) to effect a reverse stock split of our outstanding shares of common stock by a ratio of any whole number between

1-for-2 and 1-for-25 (the “Reverse Stock Split”), at any time prior to August 28, 2024, with the exact ratio to be set within that range at the discretion of our Board of Directors, without further approval or authorization of our

stockholders

|

Vote FOR

|

38

|

|

|

6

|

Approval of the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to approve Proposal 4 or Proposal 5

|

Vote FOR

|

46

|

Could other matters be decided at the Annual Meeting?

We are not aware of any other matters that will be presented and voted upon at the Annual Meeting. Our 2023 proxy statement described the requirements under our governance documents for properly submitting proposals or nominations from the

floor at this year’s Annual Meeting. The proxies will have discretionary authority, to the extent permitted by law, on how to vote on other matters that may come before the Annual Meeting.

How many votes can be cast by all stockholders?

Each share of Trevena common stock is entitled to one vote on each of the three directors to be elected and one vote on each of the other matters properly presented at the Annual Meeting. We had 18,321,010 shares of common stock outstanding and

entitled to vote on April 19, 2024.

How many votes must be present to hold the Annual Meeting?

A majority of the issued and outstanding shares entitled to vote, or 9,160,506 shares, present or by proxy, are needed for a quorum to hold the Annual Meeting. Abstentions and broker non-votes (discussed below) are included in determining

whether a quorum is present. We urge you to vote by proxy even if you plan to attend the Annual Meeting. This will help us know that enough votes will be present to hold the Annual Meeting.

2

|

INFORMATION ABOUT THE 2024 ANNUAL MEETING (CONTINUED)

|

How many votes are needed to approve each proposal? How do abstentions or broker non-votes affect the voting results?

The following table summarizes the vote threshold required for approval of each proposal and the effect on the outcome of the vote of abstentions and uninstructed shares held by brokers or nominees (referred to as broker non-votes). When a

beneficial owner does not provide voting instructions to the institution that holds the shares in street name, brokers or nominees may not vote those shares in matters deemed non-routine. Proposals 1, 3, 4 and 6 below are deemed to be “non-routine”

matters, and as a result, your broker or nominee may not vote your shares on Proposals 1, 3, 4 and 6 in the absence of your instruction. Proposals 2 and 5 are considered to be “routine” matters, and as a result, your broker or nominee may vote your

shares in its discretion either for or against Proposals 2 and 5 even in the absence of your instruction. If you are a beneficial owner and want to ensure that all of the shares you beneficially own are voted for or against Proposals 2 and 5, you

must give your broker or nominee specific instructions to do so.

|

Proposal

Number

|

Summary Description

|

Vote Required for

Approval

|

Effect of

Abstentions

|

Effect of Broker Non-

Votes

|

||

|

1

|

Election of directors

|

Plurality of shares present and entitled to vote

|

No effect

|

Not voted/No effect

|

||

|

2

|

Ratification of the appointment of independent registered public accounting firm

|

Majority of shares present and entitled to vote

|

Counted “against”

|

Shares may be voted by brokers in their discretion, but any non-votes have no effect

|

||

|

3

|

Approval, on a non-binding advisory basis, of the compensation of Company’s named executive officers

|

Non-binding advisory vote of majority of shares present and entitled to vote

|

Counted “against”

|

Not voted/No effect

|

||

|

4

|

Approval of an amendment to the Trevena, Inc. 2023 Equity Incentive Plan (the “2023 Plan”), to increase the number of shares of common stock available for issuance under the 2023 Plan

|

Majority of shares present and entitled to vote

|

Counted “against”

|

Not voted/No effect

|

||

|

5

|

Approval of an amendment to our Amended and Restated Certificate of Incorporation (as amended, the “Restated Certificate”) to effect a reverse stock split of our outstanding shares of common stock by a ratio of any whole number between

1-for-2 and 1-for-25 (the “Reverse Stock Split”), at any time prior to August 28, 2024, with the exact ratio to be set within that range at the discretion of our Board of Directors, without further approval or authorization of our

stockholders

|

Majority of shares outstanding and entitled to vote

|

Counted “against”

|

Shares may be voted by brokers in their discretion, and any non-votes will have the effect of a vote counted “against” the proposal

|

||

|

6

|

Approval of the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to adopt Proposal 4 or Proposal 5

|

Majority of shares present and entitled to vote

|

Counted “against”

|

Not voted/No effect

|

Signed but unmarked proxy cards will be voted “FOR” each proposal.

3

|

INFORMATION ABOUT THE 2024 ANNUAL MEETING (CONTINUED)

|

How do I attend the Annual Meeting?

The Annual Meeting will be held on Thursday, June 13, 2024 at 8:30 a.m. Eastern Time. The Annual Meeting will be a virtual stockholder meeting through which you can listen to the meeting, submit questions and vote online. The Annual Meeting

can be accessed by visiting http://www.virtualshareholdermeeting.com/TRVN2024 on June 13, 2024, using the 16-digit control number included on the proxy card mailed to you. We recommend that you log in a few minutes before the Annual

Meeting begins to ensure you are logged in when the meeting starts. Online check-in will begin at 8:15 a.m. Eastern Time.

How do I vote if I own shares as a record holder?

If your name is registered on Trevena’s stockholder records as the owner of shares, you are the “record holder.” If you hold shares as a record holder on the record date, there are four ways that you can vote your shares.

|

•

|

Over the Internet (before the Annual Meeting). Vote at www.proxyvote.com. The Internet voting

system is available 24 hours a day until 11:59 p.m. Eastern Time on Wednesday, June 12, 2024. Once you enter the Internet voting system, you can record and confirm (or change) your voting instructions.

|

|

•

|

By telephone. Use the telephone number shown on your proxy card. The telephone voting system is available 24 hours a day in the United States until

11:59 p.m. Eastern Time on Wednesday, June 12, 2024. Once you enter the telephone voting system, a series of prompts will tell you how to record and confirm (or change) your voting instructions.

|

|

•

|

By mail. If you received a proxy card, mark your voting instructions on the card and sign, date and

return it in the postage-paid envelope provided. If you received only a notice of Internet availability but want to vote by mail, the notice includes instructions on how to request a paper proxy card. For your mailed proxy card to be

counted, we must receive it before 8:30 a.m. Eastern Time on Thursday, June 13, 2024.

|

|

•

|

Over the Internet (during the Annual Meeting). Attend, or have your personal representative with a valid

legal proxy attend, the virtual Annual Meeting by logging in to http://www.virtualshareholdermeeting.com/TRVN2024 on June 13, 2024, using the 16-digit control number included on the proxy card that was mailed to you.

|

How do I vote if my Trevena shares are held by a bank, broker or custodian?

If your shares are held by a bank, broker or other custodian (commonly referred to as shares held “in street name”), the holder of your shares will provide you with a copy of this proxy statement, a voting instruction form and directions on how

to provide voting instructions. These directions may allow you to vote over the Internet or by telephone.

Proposals 2 and 5 are deemed to be “routine” matters. Therefore, if you are a beneficial owner of shares registered in the name of your broker or other nominee and you fail to provide instructions to your broker or nominee as to how to vote your

shares on these proposals, your broker or nominee will have the discretion to vote your shares on such proposals. Accordingly, if you fail to provide voting instructions to your broker or nominee, your broker or nominee can vote your shares on the

proposals in a manner that is contrary to what you intend. For example, if you are against the approval of Proposals 2 and 5 but you do not provide any voting instructions to your broker, your broker can nonetheless vote your shares “FOR” Proposals

2 and 5. Proposals 1, 3, 4 and 6 below are deemed to be “non-routine” matters, and as a result, your broker or nominee may not vote your shares on Proposals 1, 3, 4 and 6 in the absence of your instruction. See the discussion above for the impact

in the event that you fail to instruct your broker to vote. If you are a beneficial owner of shares registered in the name of your broker or other nominee, we strongly encourage you to provide voting instructions

to the broker or nominee that holds your shares to ensure that your shares are voted in the manner in which you want them to be voted.

4

|

INFORMATION ABOUT THE 2024 ANNUAL MEETING (CONTINUED)

|

INFORMATION ABOUT THE 2024 ANNUAL MEETING (CONTINUED)

If you hold shares in street name and want to vote over the internet during the Annual Meeting, you will need to ask your bank, broker or custodian to provide you with a valid legal proxy. You will need the proxy in hand when attending the

Annual Meeting in order to vote. Please note that if you request a legal proxy from your bank, broker or custodian, any previously executed proxy will be revoked and your vote will not be counted unless you vote over the Internet during the Annual

Meeting or appoint another valid legal proxy to vote on your behalf.

Can I change my vote?

Yes. If you are a record holder, you may:

|

•

|

Enter new instructions by telephone or Internet voting before 11:59 p.m. Eastern Time on Wednesday, June 12, 2024;

|

|

•

|

Send a new proxy card with a later date than the card submitted earlier. We must receive your new proxy card before 8:30 a.m. Eastern Time on Thursday, June 13, 2024;

|

|

•

|

Write to the Corporate Secretary at the address listed on page 66. Your letter should contain the name in which your shares are registered, the date of the proxy you wish to revoke or change, your new voting instructions, if

applicable, and your signature. Your letter must be received by the Corporate Secretary before 8:30 a.m. Eastern Time on Thursday, June 13, 2024; or

|

|

•

|

Vote over the internet during the Annual Meeting (or have a personal representative with a valid proxy vote). Note that simply attending the Annual Meeting without voting will not, by itself, revoke your proxy.

|

If you hold your shares in street name, you may:

|

•

|

Submit new voting instructions in the manner provided by your bank, broker or other custodian; or

|

|

•

|

Contact your bank, broker or other custodian to request a proxy to vote over the internet during the Annual Meeting.

|

Who will count the votes? Is my vote confidential?

Trevena’s Executive Vice President, Chief Operating Officer & Chief Financial Officer, Barry Shin, has been appointed Inspector of Election for the Annual Meeting. The Inspector of Election will determine the number of shares outstanding,

the shares represented at the Annual Meeting, the existence of a quorum, and the validity of proxies and ballots, and will count all votes and ballots.

All votes are confidential. Your voting records will not be disclosed to us, except as required by law, in contested Board elections or certain other limited circumstances.

Can I ask questions at the Annual Meeting?

If you would like to submit a question, you may do so by joining the virtual Annual Meeting at http://www.virtualshareholdermeeting.com/TRVN2024 and typing your question in the box in the Annual Meeting portal.

What if I need technical assistance accessing or participating in the virtual Annual Meeting?

If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Stockholder Meeting log in page. Technical support will be

available starting at 8:00 a.m. Eastern Time on Thursday, June 13, 2024.

5

|

INFORMATION ABOUT THE 2024 ANNUAL MEETING (CONTINUED)

|

Who pays for the proxy solicitation and how will Trevena solicit votes?

We pay the cost of preparing our proxy materials and soliciting your vote. Proxies may be solicited on our behalf by our directors, officers, employees and agents, including, but not limited to, our proxy solicitor Alliance Advisors, LLC

(“Alliance Advisors”), by telephone, electronic or facsimile transmission or in person. We have retained Alliance Advisors to assist in the solicitation of proxies on behalf of the Board for an estimated fee of $10,000 plus call center costs and

reimbursement of reasonable expenses. We may choose to enlist the help of banks and brokerage houses in soliciting proxies from their customers and, in all cases, will reimburse them for their related out-of-pocket expenses. IF YOU NEED ASSISTANCE

WITH THE VOTING OF YOUR SHARES, YOU MAY CONTACT ALLIANCE ADVISORS TOLL-FREE AT (833) 501-4709.

Where can I find the voting results of the Annual Meeting?

We will publish the voting results of the Annual Meeting on a Current Report on Form 8-K filed with the SEC. The Form 8-K will be available online at www.sec.gov within four business days following the end of our Annual Meeting. If final

voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to

us, file an additional Form 8-K to publish the final results.

|

IMPORTANT INFORMATION IF YOU PLAN TO VIRTUALLY ATTEND THE ANNUAL MEETING

You must be able to show that you owned Trevena common stock on the record date, April 19, 2024, in order to gain admission to the Annual Meeting. When you log in to http://www.virtualshareholdermeeting.com/TRVN2024, you will be required to enter the 16-digit control number contained on your proxy card that evidences that you are a stockholder of record. Registration for the Annual Meeting will begin at 8:15 a.m.

Eastern Time on June 13, 2024.

|

6

|

CORPORATE GOVERNANCE

|

GOVERNANCE POLICIES AND PRACTICES

Trevena is committed to ensuring strong corporate governance practices on behalf of our stockholders. Trevena’s Corporate Governance Guidelines, together with the charters of the Audit, Compensation and Nominating and Corporate Governance

Committees, establishes a framework of policies and practices for our effective governance. Our Corporate Governance Guidelines, which are available at www.trevena.com/investors/corporate-governance , address Board composition, leadership,

performance and compensation, director qualifications, director independence, committee structure and roles, and succession planning, among other things. The Board, the Nominating and Corporate Governance Committee and the other committees

regularly review their governance policies and practices and developments in corporate governance and update these documents as they deem appropriate for Trevena.

The following describes some of our most significant governance practices by area.

|

BOARD STRUCTURE AND PROCESS

|

|

OVERSIGHT OF EXECUTIVE COMPENSATION |

|

✔ 7 Directors on Board

✔ 6 Independent Directors (86%)

✔ Classified Board Divided into Three Classes

✔ Diverse Board as to Composition, Skills and Experience

✔ Lead Independent Director of the Board

✔ Independent Audit, Compensation, and Nominating and

Corporate Governance Committees

✔ Annual Self-Evaluations of the Board and its Committees

|

|

✔ Pay-for-Performance Executive Compensation Philosophy

✔ Independent Compensation Consultant to the Compensation

Committee

✔ “Double-trigger” Vesting of Equity on Change of Control

✔ No Tax Gross-up on Change of Control

|

|

|

ALIGNMENT WITH STOCKHOLDER INTERESTS

|

|

|

|

✔ High Percentage of Variable (“at risk”) Named

Executive Officer Pay

✔ Significant Portion of Director Compensation

Delivered in Trevena Common Stock

✔ Restrictions on Hedging of Trevena Common

Stock |

|

For more information about our executive compensation governance policies and practices, see Executive Compensation beginning on page 47.

7

|

CORPORATE GOVERNANCE (CONTINUED)

|

ROLE OF THE BOARD AND LEADERSHIP STRUCTURE

The Board’s primary role is the oversight of the management of Trevena’s business affairs and assets in accordance with the Board’s fiduciary duties to stockholders under Delaware law. To fulfill its responsibilities to our stockholders,

Trevena’s Board, both directly and through its committees, regularly engages with management, promotes management accountability and reviews the most critical issues that face Trevena. Among other things, the Board reviews the Company’s strategy

and mission, its execution on financial and strategic plans, and succession planning. The Board also oversees risk management and determines the compensation of the Chief Executive Officer (CEO), in consultation with the Compensation Committee.

All directors play an active role in overseeing the Company’s business strategy at the Board and committee levels. The Board is committed to meeting the dynamic needs of the Company and focusing on the interests of its stockholders and, as a

result, regularly evaluates and adapts its composition, role, and relationship with management.

Independent Board Members

Trevena believes in the importance of a board comprised largely of independent, non-employee directors. Currently, the Board has determined that all Trevena directors, other than the Company’s CEO, Carrie L. Bourdow, are independent under Nasdaq

listing standards and SEC rules. Similarly, at the committee level, all committee members are independent.

Chair of the Board and Lead Independent Director

On November 9, 2023, Leon O. Moulder, Jr. retired as Chairman of the Board. Following Mr. Moulder’s retirement, the Board appointed Carrie L. Bourdow as the Chair of the Board, effective November 9, 2023. Also effective on November 9, 2023, the

Board, upon the recommendation of the Nominating and Corporate Governance Committee, established the role of Lead Independent Director of the Board and appointed Scott Braunstein, M.D to that role.

The Board does not have a set policy on whether or not the CEO and the Chair of the Board should be separate. The Board reviews the Company’s board leadership structure annually. As part of this process, the Board considered the structures used

by peer companies, alternative structures and the effectiveness of the Company’s current structure. The Board believes that the change to having Ms. Bourdow serve as Chair is important because it reflects the Board’s belief that the CEO can use her

experience and performance at the Company to function as the Company’s overall leader, while the Lead Independent Director provides independent leadership to the directors and serves as an intermediary between the independent directors and the

Chair. The resulting structure sends a message to our employees, customers and stockholders that we believe in having strong, unifying leadership at the highest levels of management. At the same time, having a Lead Independent Director with a

well-defined role provides an appropriate level of independent oversight and an effective channel for communications when needed.

The following tables describe the key responsibilities that the Board has delegated to the Chair of the Board and the Lead Independent Director:

|

|

CHAIR RESPONSIBILITIES |

|

|

• Serves as principal representative of the Board

• Develops schedule and agenda of Board meetings, in consultation with other directors

• Presides over Board and stockholder meetings

• Facilitates discussion among independent directors on key issues

• Acts as a liaison between the Board and management

|

|

• Leads the Board in CEO succession planning

• Engages in the director recruitment process

• Represents the Company in interactions with external stakeholders,

at the request of the Board |

8

|

CORPORATE GOVERNANCE (CONTINUED)

|

|

|

LEAD INDEPENDENT DIRECTOR RESPONSIBILITIES

|

|

|

• Presides over Board and stockholder meetings in the absence of, or upon the request

of, the Chair

• Presides over all executive sessions of the Company’s independent directors

|

|

• Facilitates a strong, two-way flow of information and communication between the independent directors

and the Chair of the Board

• If requested by major stockholders, is available for consultation and direct communication

|

Risk Oversight

Risk is inherent with every business, and we face a number of risks, including, but not limited to, strategic, financial, business and operational, legal and compliance and cybersecurity risks. One of the Board’s

key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board

standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk

appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to

govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. The

Company’s Chief Compliance Officer reports on a periodic basis to the Chair of the Audit Committee regarding matters of material legal and regulatory compliance, as well as the systems the Company has installed to monitor and mitigate these risks.

Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee

assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as

quickly as possible.

OTHER BOARD PRACTICES

Trevena employs a number of other practices directed to ensure the highest level of corporate governance oversight on behalf of its stockholders. The following table describes some of these practices in more detail.

|

PRACTICES DIRECTED TO INDIVIDUAL TREVENA DIRECTORS

|

|

|

Limits on Public Company

Directorships

|

The Board does not believe that its directors should be prohibited from serving on boards of other organizations. However, the Nominating and Corporate Governance Committee takes into account the nature of and time involved in a

director’s service on other boards in evaluating the suitability of individual directors and making its recommendations to the Board. The Company expects that each of its directors will be able to dedicate the time and resources sufficient

to ensure the diligent performance of his or her duties on the Company’s behalf, including attending board and applicable committee meetings.

|

9

|

CORPORATE GOVERNANCE (CONTINUED)

|

|

Change in Director’s Principal

Position

|

If a director changes his or her principal occupation or principal background association held when such director was originally invited to join the Board, that director is required to tender his or her resignation to the Nominating and

Corporate Governance Committee. The Committee will then recommend to the Board whether to accept or decline the resignation.

|

|

Continuing Education for

Directors

|

The Board is regularly updated on Trevena’s businesses, strategies, operations and employee matters, as well as external trends and issues that affect the Company. The Nominating and Corporate Governance Committee oversees the continuing

education process and it encourages directors to attend continuing education courses relevant to their service on Trevena’s Board. Trevena reimburses directors for expenses they incur in connection with continuing education courses.

|

|

Attendance at Annual Meeting

of Stockholders

|

The Board encourages and expects directors and nominees for director to attend the Annual Meeting. In 2023, 75% of the directors attended the annual meeting of stockholders.

|

|

PRACTICES DIRECTED TO TREVENA BOARD PROCESSES

|

|

|

Board Executive Sessions

|

As part of all regularly scheduled Board meetings, the Lead Independent Director presides over all executive sessions of the Board’s independent directors. At each regularly scheduled meeting held in 2023, the independent members of the

Board met in executive session. Each Board committee also met in executive session on a regular basis in connection with their respective meetings.

|

|

Director Access to Management

|

Independent directors have unfettered access to members of senior management and other key employees.

|

|

Independent Advisors

|

The Board and its committees are able to access and retain independent advisors as and to the extent they deem necessary or appropriate.

|

|

Management Succession

Planning

|

At the direction of the Chair, the Board oversees management succession planning. As appropriate, the Board will develop and approve succession plans for the Company’s CEO and review and approve succession plans for the Company’s senior

management together with the input of the Nominating and Corporate Governance Committee and the CEO.

|

|

Annual Board Evaluation

|

Each year, the Nominating and Corporate Governance Committee oversees the self-evaluation of the Board and its committees. Each Board committee also is responsible for conducting a self-assessment to identify potential areas of

improvement. On an ongoing basis, directors offer suggestions and recommendations intended to further improve Board performance.

|

|

PRACTICES DIRECTED TO TREVENA STOCKHOLDERS

|

|

|

Alignment of Director

Compensation

|

Trevena delivers a significant portion of its non-employee director compensation in the form of options to purchase Trevena common stock. For more information on non-employee director compensation, see page 23.

|

|

No Stockholder Rights Plan

(“Poison Pill”)

|

Trevena does not have a stockholder rights plan.

|

10

|

CORPORATE GOVERNANCE (CONTINUED)

|

BOARD MEETINGS AND COMMITTEES

In 2023, there were 9 meetings of the Board, 4 meetings of the Nominating and Corporate Governance Committee, 6 meetings of the Compensation Committee, and 4 meetings of the Audit Committee. Overall director attendance at Board and committee

meetings in 2023 was approximately 94%. In addition to formal Board meetings, the Board engages with management throughout the year on critical matters and topics.

The Board has the following three standing committees: Nominating and Corporate Governance, Compensation, and Audit. In its discretion and subject to Delaware law, the Board and each committee may delegate all or a portion of its authority to

subcommittees of one or more of its members. Additional information can be found in the committee charters adopted by the Board and available on Trevena’s website at www.trevena.com/investors/corporate-governance. Each committee member

meets the independence standards required for the committee on which he or she serves.

|

NOMINATING AND CORPORATE

GOVERNANCE COMMITTEE

|

|

COMPENSATION COMMITTEE |

|

|

|

|

|

Chair: Jake R. Nunn

|

|

Chair: Anne M. Phillips, M.D.

|

| Other Committee Members: Anne M. Phillips, M.D., |

|

Other Committee Members: Mark Corrigan, M.D.,

|

| Marvin Johnson |

|

Barbara Yanni, Scott Braunstein, M.D.

|

|

|

|

|

|

Meetings Held in 2023: 4

|

|

Meetings Held in 2023: 6

|

|

|

|

|

|

Primary Responsibilities:

|

|

Primary Responsibilities:

|

|

• Assisting the Board by identifying qualified candidates for director, assessing director independence

and recommending to the Board the director nominees.

• Making recommendations to the Board regarding the composition, organization and governance of the

Board, including recommendations regarding the membership and chairperson of each Board committee.

• Reviewing, advising and reporting to the Board on the Board’s membership, structure, organization,

governance practices and performance.

• Developing, recommending and maintaining a set of Corporate Governance Guidelines applicable to the

Company.

• Overseeing the review and evaluation of the Board and its committees.

|

|

• Approving the Company’s long-term strategy of compensation for employees and

directors.

• Reviewing the corporate goals and objectives applicable to the compensation of the

CEO, evaluating the CEO’s performance in light of these goals and objectives and, based on this review and evaluation, recommending the compensation of the CEO to the independent members of the Board for approval.

• Reviewing and approving the compensation of the Company’s executive officers and key

senior management, other than the CEO.

• Supervising the administration of the Company’s equity incentive plans and approving

equity compensation awards pursuant to these plans.

• Overseeing the management of risks related to the Company’s executive and overall

compensation, benefits plans, practices and policies.

• Maintaining direct responsibility for the appointment, compensation and oversight of

the work of any compensation consultant, legal counsel or other external adviser retained by the Committee

|

11

|

CORPORATE GOVERNANCE (CONTINUED)

|

| AUDIT COMMITTEE |

|

|

|

Chair: Barbara Yanni

|

|

|

|

Other Committee Members: Scott Braunstein, M.D., Mark Corrigan, M.D., Jake R.

Nunn

|

|

|

|

Meetings Held in 2023: 4

|

|

|

|

Primary Responsibilities:

|

|

• Evaluating the performance, objectivity, independence and qualifications of, and retaining or terminating the engagement of, Trevena’s independent

registered public accounting firm.

• Representing and assisting the Board in fulfilling its oversight responsibilities regarding the adequacy and effectiveness of internal controls, including

financial and disclosure controls and procedures, and the quality and integrity of the Company’s financial statements.

• Reviewing with management and the independent registered public accounting firm annual and quarterly financial statements, earnings releases, earnings

guidance and significant accounting policies.

• Overseeing compliance with material legal and regulatory requirements.

• Overseeing the Company’s enterprise risk management program and advising the Board on financial and enterprise risks.

• Maintaining procedures for and reviewing the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or

auditing matters and the confidential, anonymous submissions by employees and others of any concerns about questionable accounting and auditing matters.

|

|

|

|

Financial Expertise and Financial Literacy:

|

| The Board has determined that Dr. Braunstein is an “audit committee financial expert” as defined in the SEC rules, and all members of the Audit Committee are financially literate within the meaning of the Nasdaq listing standards. |

12

|

CORPORATE GOVERNANCE (CONTINUED)

|

DIRECTOR INDEPENDENCE

The current Board includes six non-employee directors. To be independent under Nasdaq listing standards, the Board must affirmatively determine that a director has no material relationships with the Company directly, or as an officer,

stockholder or partner of an organization that has a relationship with the Company (a “Material Relationship”). In making its assessment, the Board considers all relevant facts and circumstances, including whether transactions with such

organizations are in the ordinary course of Trevena’s business and/or the amount of such transactions (in aggregate or as a percentage of the organization’s revenues or assets). The Board also considers that the Company may sell products and

services to, and/or purchase products and services from, organizations affiliated with our directors and may hold investments (generally, debt securities) in organizations affiliated with our directors. On an annual basis, the Board, through its

Nominating and Corporate Governance Committee, reviews relevant relationships between directors, their immediate family members and the Company, consistent with Trevena’s independence standards. Trevena’s standards, which are detailed in Trevena’s

Corporate Governance Guidelines available at www.trevena.com/investors/corporate-governance, conform to the independence requirements set forth in the Nasdaq’s listing standards.

The Board consults with our counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent Nasdaq listing

standards.

Based on its review of director relationships, the Board has affirmatively determined that there are no Material Relationships between the non-employee directors and the Company and each of the non-employee directors is independent as defined in

both the Nasdaq listing standards (including those applicable to certain board committees) and Trevena’s director independence standards.

CORPORATE COMPLIANCE PROGRAM

Our business is subject to extensive regulations. Management has designed and implemented a comprehensive corporate compliance program as part of our commitment to comply fully with applicable criminal, civil and administrative laws, rules and

regulations and to maintain the high standards of conduct we expect from all of our employees. We continuously review this compliance program and work to enhance it as and when appropriate. The primary purposes of the compliance program include,

among other things:

|

|

• |

Assessing and identifying risks affecting our Company and its products;

|

|

|

• |

Training and educating employees and certain outside professionals who provide services to the Company to promote awareness of legal and regulatory requirements, a culture of compliance, and the necessity of complying with all applicable

laws, rules, regulations and requirements;

|

|

|

• |

Developing and implementing compliance policies and procedures and creating controls to support compliance with applicable laws, rules, regulations and requirements and our policies and procedures;

|

|

|

• |

Auditing and monitoring the activities of our operations and business support functions to identify and mitigate risks and potential instances of noncompliance in a timely manner; and

|

|

|

• |

Ensuring that we promptly take steps to resolve any instances of noncompliance and address areas of weakness or potential noncompliance.

|

We have a Code of Conduct and Business Ethics that guides and binds each of our employees, officers and directors. We use an anonymous compliance hotline for employees and outside parties to report potential instances of noncompliance and file

whistleblower complaints. Our Chief Compliance Officer administers the compliance program and chairs the Company’s Compliance Committee. The Chief Compliance Officer reports directly to our Chief Executive Officer and meets regularly with the Chair

of the Audit Committee.

13

|

CORPORATE GOVERNANCE (CONTINUED)

|

CODE OF CONDUCT AND BUSINESS ETHICS

Trevena is committed to integrity, legal compliance and ethical conduct. All directors and employees, including our executive officers, must comply with the Company’s Code of Conduct and Business Ethics. The Code of Conduct and Business Ethics

and Trevena’s related policies and procedures address major areas of professional conduct, including, among others, conflicts of interest, protection of private, sensitive or confidential information, employment practices, insider trading and

adherence to laws and regulations affecting the conduct of Trevena’s business. The Code of Conduct and Business Ethics is available on our website at www.trevena.com/investors/corporate-governance.

The Code of Conduct and Business Ethics requires all directors and employees to avoid any conflict or potential conflict between their personal interests (including those of their significant others and immediate family) and the best interests

of the Company. Any conflict or potential conflict must be brought to the attention of the Chief Compliance Officer for review and disposition. In addition, directors and officers cannot participate in a personal transaction with Trevena without

first notifying and obtaining the approval of the Audit Committee in accordance with the Company related person transaction policy described below.

CERTAIN TRANSACTIONS

Transactions with Related Persons

Trevena has adopted a written policy that sets forth our procedures for the identification, review, consideration and approval or ratification of related person transactions. For purposes of our policy only, a related person transaction is a

transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which we and any related person are, were or will be participants in which the amount involved exceeds $120,000. Transactions

involving compensation for services provided to us as an employee or director are not covered by this policy. A related person is any executive officer, director or beneficial owner of more than 5% of any class of our voting securities, including

any of their immediate family members and any entity owned or controlled by such persons.

Under the policy, if a transaction has been identified as a related person transaction, including any transaction that was not a related person transaction when originally consummated or any transaction that was not initially identified as a

related person transaction prior to consummation, our management must present information regarding the transaction to our Audit Committee, or, if Audit Committee approval would be inappropriate, to another independent body of our Board, for

review, consideration and approval or ratification. The presentation must include a description of, among other things, the material facts, the interests, direct and indirect, of the related persons, the benefits to us of the transaction and

whether the transaction is on terms that are comparable to the terms available to or from, as the case may be, an unrelated third party or to or from employees generally. Under the policy, we will collect information that we deem reasonably

necessary from each director, executive officer and, to the extent feasible, significant stockholder to enable us to identify any existing or potential related-person transactions and to effectuate the terms of the policy. In addition, under our

Code of Conduct and Business Ethics, our employees and directors have an affirmative responsibility to disclose any transaction or relationship that reasonably could be expected to give rise to a conflict of interest. In considering related person

transactions, our Audit Committee, or other independent body of our Board, will take into account the relevant available facts and circumstances including, but not limited to:

|

|

• |

the risks, costs and benefits to us;

|

|

|

• |

the impact on a director’s independence in the event that the related person is a director, immediate family member of a director or an entity with which a director is affiliated;

|

|

|

• |

the availability of other sources for comparable services or products; and

|

|

|

• |

the terms available to or from, as the case may be, unrelated third parties or to or from employees generally.

|

The policy requires that, in determining whether to approve, ratify or reject a related person transaction, our Audit Committee, or other independent body of our Board, must consider, in light of known circumstances, whether the transaction is

in, or is not inconsistent with, our best interests and those of our stockholders, as our Audit Committee, or other independent body of our Board, determines in the good faith exercise of its discretion.

14

|

CORPORATE GOVERNANCE (CONTINUED)

|

Based upon this review, there are no related person transactions requiring disclosure under SEC rules.

Compensation Committee Interlocks and Insider Participation

None of our directors who currently serve as members of our Compensation Committee is, or has at any time during the past year been, one of our officers or employees. None of our executive officers currently serves, or in the past year has

served, as a member of the Board or Compensation Committee of any other entity that has one or more executive officers serving on our Board or Compensation Committee.

[CONTINUED ON NEXT PAGE]

15

|

PROPOSAL 1. ELECTION OF DIRECTORS

|

The Board is elected by Trevena’s stockholders and is divided into three classes, each with a three-year term. There are currently seven members of the Board. Vacancies on the Board may be filled only by persons elected by a majority of the

remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s

successor is duly elected and qualified.

At the Annual Meeting, the Board is nominating for election by stockholders three Class II directors, each of whom currently is a director of the Company. If elected at the Annual Meeting, each of these nominees would serve until the 2027 Annual

Meeting of Stockholders and until her or his successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation, or removal.

The role of the Board, its leadership structure and governance practices are described above in the Corporate Governance section. This section describes the process for director elections and director nominations, identifies the director

responsibilities and qualifications considered by the Board and the Nominating and Corporate Governance Committee in selecting and nominating directors, and presents the biographies, skills and qualifications of the director nominees and those

directors continuing in office.

PROCESS FOR SELECTING AND NOMINATING DIRECTORS

The Nominating and Corporate Governance Committee may retain a third‑party search firm to assist in identifying and evaluating candidates for Board membership. The Nominating and Corporate Governance Committee also considers suggestions for

Board nominees submitted by stockholders, which are evaluated using the same criteria as new director candidates and current director nominees. Instructions for how to submit stockholder nominations to the Board can be found on page 66.

Once a potential candidate has been identified, the Nominating and Corporate Governance Committee reviews the background of new director candidates and presents them to the Board for consideration before selection. When considering director

candidates and the current composition of the Board, the Nominating and Corporate Governance Committee and the Board consider how each candidate’s background, experiences, skills, prior board and committee service and/or commitments will contribute

to the diversity of the Board. Candidates interview with the Chair of the Nominating and Corporate Governance Committee and the Chair and Lead Independent Director of the Board, as well as other members of the Board, as appropriate. The

Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having strong

personal and professional ethics, integrity and values. The Nominating and Corporate Governance Committee also intends to consider additional criteria as follows: relevant expertise upon which to be able to offer advice and guidance to management;

sufficient time to devote to the affairs of the Company; demonstrated excellence in his or her field; the ability to exercise sound business judgment; diversity; the commitment to rigorously represent the long-term interests of our stockholders;

and independence. In addition, the Board and the Nominating and Corporate Governance Committee will consider the talents, ages, skills, diversity, experience, expertise and such other factors as appropriate given the current needs of the Board and

the Company to maintain an appropriate and effective balance of knowledge, experience and capability on the Board as a whole.

The Nominating and Corporate Governance Committee assesses the Board’s composition as part of the annual evaluation of the Board. When considering whether to nominate current directors for re-election, the Nominating and Corporate Governance

Committee and the Board review the results of the annual evaluation and the qualifications, characteristics, skills and experience that it believes are important for representation on the Board. The Nominating and Corporate Governance Committee

and the Board take into consideration these criteria for Trevena directors as part of the director recruitment, selection, evaluation, and nomination process. While the Board does not have a formal policy with regard to diversity, the Nominating

and Corporate Governance Committee and the Board strive to ensure that the Board is composed of individuals who together possess a breadth and depth of experience relevant to the Board’s oversight of Trevena’s business and strategy. In accordance

with Nasdaq Rule 5606, the table below reflects our Board diversity as of April 29, 2024.

16

PROPOSAL 1: ELECTION OF DIRECTORS (CONTINUED)

BOARD DIVERSITY MATRIX (as of April 29, 2024)

Total Number of Directors: 7

|

Gender Identity

|

Female

|

Male

|

Non-Binary

|

Did Not Disclose

|

|

Directors

|

3

|

4

|

-

|

-

|

|

Demographic Background

|

||||

|

Hispanic or Latinx

|

-

|

-

|

-

|

-

|

|

Native American or Alaskan Native

|

-

|

-

|

-

|

-

|

|

Asian

|

-

|

-

|

-

|

-

|

|

Black or African American

|

-

|

1

|

-

|

-

|

|

Native Hawaiian or Pacific Islander

|

-

|

-

|

-

|

-

|

|

White

|

3

|

3

|

-

|

-

|

|

Two or More Races or Ethnicities

|

-

|

-

|

-

|

-

|

|

LGBTQ+ Community

|

-

|

-

|

-

|

-

|

|

Did Not Disclose Demographic Background

|

-

|

-

|

-

|

-

|

|

Other Disclosures

|

||||

|

Christian

|

-

|

1

|

-

|

-

|

BOARD OF DIRECTORS’ NOMINEES

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board is nominating the three Class II directors listed below for re-election for terms expiring at the 2027 Annual Meeting of Stockholders. All nominees have

consented to serve, and the Board does not know of any reason why any nominee would be unable to serve. If a nominee becomes unavailable or unable to serve before the Annual Meeting, the Board may reduce its size or designate another nominee. If

the Board designates a nominee, your proxy will be voted for the substitute nominee.

Below are biographies, skills and qualifications for each of the nominees and for each of the directors continuing in office. Each of the director nominees currently serves on the Board. The Board believes that the combination of the various

experiences, skills and qualifications represented contributes to an effective and well-functioning Board and that the nominees and directors continuing in office possess the qualifications, based on the criteria described above, to provide

meaningful oversight of Trevena’s business and strategy.

Approval of this Proposal 1 requires “FOR” votes from the holders of a plurality of shares present or represented by proxy and entitled to vote at the Annual Meeting. If you “ABSTAIN” from voting, it will have no effect on the outcome of the

vote on Proposal 1.

|

The Board unanimously recommends that stockholders vote FOR each of the Class II nominees listed below as set forth in this Proposal 1.

|

17

PROPOSAL 1: ELECTION OF DIRECTORS (CONTINUED)

CLASS II DIRECTORS WHO, IF ELECTED AS PART OF THIS PROXY, WILL CONTINUE IN OFFICE UNTIL THE 2027 ANNUAL MEETING

|

Independent

Director Since: 2013

Age: 53

Board Committee(s):

• Nominating and

Corporate Governance

(Chair) • Audit

|

|||

|

Jake R. Nunn

Mr. Nunn is currently a venture partner at SR One Capital Management, a biotech venture capital firm. Previously, he was a venture advisor at New Enterprise Associates, Inc., a venture capital firm, where he

was a partner from June 2006 until January 2019. From January 2001 to June 2006, Mr. Nunn served as a Partner and an analyst for the MPM BioEquities Fund, a life sciences fund at MPM Capital, L.P., a private equity firm. Previously, Mr.

Nunn was a healthcare research analyst and portfolio manager at Franklin Templeton Investments and an investment banker with Alex. Brown & Sons. Mr. Nunn currently serves on the board of directors of Addex Therapeutics Ltd. (ADXN), and

Regulus Therapeutics Inc. (RGLS), each a public biopharmaceutical company. Mr. Nunn previously was a Director of Dermira, Inc. (acquired by Eli Lilly and Company), Hyperion Therapeutics, Inc. (acquired by Horizon Pharma PLC) and TriVascular

Technologies, Inc. (acquired by Endologix, Inc.). Mr. Nunn received his A.B. in economics from Dartmouth College and his M.B.A. from the Stanford Graduate School of Business. Mr. Nunn holds the Chartered Financial Analyst designation, is a

member of the C.F.A. Society of San Francisco, and recently completed the Stanford Graduate School of Business Directors’ Consortium executive education program.

|

|||

|

Skills and Qualifications

Our Board believes that Mr. Nunn’s experience investing in life sciences, specialty pharmaceuticals, biotechnology and medical device companies, as well as his business and financial background, qualify him

to serve on our Board.

|

(CONTINUED ON NEXT PAGE)

18

|

PROPOSAL 1: ELECTION OF DIRECTORS (CONTINUED)

|

|

Independent

Director Since: 2021

Age: 61

Board Committee(s):

• Nominating and

Corporate Governance

|

|||

|

Marvin H. Johnson, Jr.

Mr. Johnson’s professional experience included over 34 years at Merck & Co., predominantly in the area of commercial operations, that spanned a diverse and increasing set of responsibilities. Mr. Johnson

held Senior Sales and Marketing leadership positions across multiple therapeutic categories including Diabetes, Acute Care, Neurology, Respiratory, Cardiovascular, Pain Management and Sleep Disorders. His experiences have included leading

large scale regional, national and global sales and marketing organizations worth over $3 billion in revenue, and he has extensive experience launching products in the U.S and abroad. Mr. Johnson was most recently Chief Learning Officer at

Merck from 2016 until his retirement in October 2018.

Mr. Johnson currently serves on the board of directors of Marinus Pharmaceuticals, Inc. (MRNS). Mr. Johnson is also the Chair on the Board of Trustees for Tabor Children’s Services, Inc. a nonprofit child

welfare agency where he has served as a board member since 2014. From December 2018 to March 2024, Mr. Johnson served on the strategic advisory board for GP Strategies Corporation, a global workforce transformation learning solutions

provider. Mr. Johnson received his Bachelor of Science degree in Marketing from the Pennsylvania State University and in August 2023 joined the Penn State University, Abington Alumni Advisory Board.

|

|||

|

Skills and Qualifications

Our Board believes that Mr. Johnson’s experience across multiple therapeutic categories including Acute Care, Neurology, Respiratory, Cardiovascular, and Pain Management enable him to make valuable contributions to the Board.

|

|||

|

Independent

Director Since: 2023

Age: 66

Board Committee(s):

• Compensation

• Audit

|

Mark Corrigan, M.D.

Dr. Corrigan currently serves as a member of the board of directors of Wave Life Sciences and as President of Silver Creek Pharmaceuticals, a privately held clinical stage company . He also Chairs the Board of Elios Therapeutics, a

private company. In addition, Dr. Corrigan is a visiting professor in the psychiatry department at Harvard’s Brigham and Women’s Hospital in Boston, MA. Dr. Corrigan previously served as acting CEO at Tremeau Pharmaceuticals from 2016

until December 2023. From 2019 to 2021 Dr. Corrigan served as CEO of Correvio Pharma and prior to that role Dr. Corrigan served as Director, President and Chief Executive Officer of Zalicus, Inc. from 2010 to 2014. Formerly, Dr. Corrigan

was Executive Vice President of Research and Development at the specialty pharmaceutical company Sepracor Inc. He also spent 10 years with Pharmacia & Upjohn where he served as Group Vice President of Global Clinical Research and

Experimental Medicine. He has served on the board of directors of Cubist Pharmaceuticals, where he chaired the Scientific Committee, Avanir Pharmaceuticals, Inc., Novelion and CoLucid. Before entering the pharmaceutical industry, Dr.

Corrigan was in academic research at the University of North Carolina at Chapel Hill School of Medicine. Dr. Corrigan holds a Bachelor of Science from the University of Virginia, as well as an MD from the University of Virginia School of

Medicine.

|

19

PROPOSAL 1: ELECTION OF DIRECTORS (CONTINUED)

|

Skills and Qualifications

Our Board believes that Dr. Corrigan’s extensive experience as a board member of public biotech companies enable him to make valuable contributions to the Board. He has also served on Audit and

Compensation Committees of other Boards, as well as Chairman. Dr. Corrigan also brings scientific rigor to the Board given his experience as a physician scientist and former head of Research and Development.

|

CLASS III DIRECTORS WHO WILL CONTINUE IN OFFICE UNTIL THE 2025 ANNUAL MEETING

|

Independent

Director Since: 2018

Age: 60

Board Committee(s):

• Compensation

|

Scott Braunstein, M.D.

Dr. Braunstein joined the Board in September 2018 and was appointed Lead Independent Director in November 2023. Dr. Braunstein is currently Chief Executive Officer and Chairman of the board of directors at

Marinus Pharmaceuticals, Inc. (MRNS). Dr. Braunstein is also an Operating Partner at Aisling Capital Management LP, a life sciences private equity firm, where he has served since 2015. From 2015 to 2018, Dr. Braunstein also served as Chief

Operating Officer, SVP of Corporate Strategy, and Chief Strategy Officer at Pacira Pharmaceuticals, Inc. (now known as Pacira BioSciences, Inc.) (PCRX), a specialty pharmaceutical company. Dr. Braunstein was previously a healthcare analyst

and managing director on the U.S. Equity team of J.P. Morgan Asset Management and served as the portfolio manager for the J.P. Morgan Global Healthcare fund. Dr. Braunstein was responsible for managing investments in pharmaceuticals,

biotechnology, and medical devices. Dr. Braunstein is currently a member of the board of directors for Marinus and Caribou Biosciences (CRBU), each a public biotechnology company. Dr. Braunstein is also a member of the board of directors of

SiteOne Therapeutics, a private company. Dr. Braunstein previously served as a member of the board of directors of Esperion Therapeutics, Inc. (ESPR), Ziopharm Oncology, Inc. (now known as Alaunos Therapeutics) and Constellation

Pharmaceuticals (acquired by MorphoSys). Dr. Braunstein began his career as a practicing physician at the Summit Medical Group and as Assistant Clinical Professor at Albert Einstein College of Medicine and Columbia University Medical

Center. Dr. Braunstein received his M.D. from the Albert Einstein College of Medicine and his B.S. from Cornell University.

Skills and Qualifications

Our Board believes that Dr. Braunstein’s strategic insight, extensive experience as both a pharmaceutical company executive and an investor in healthcare companies, and knowledge as a physician position him

to make valuable contributions to the Board.

|

20

PROPOSAL 1: ELECTION OF DIRECTORS (CONTINUED)

CLASS I DIRECTORS WHO WILL CONTINUE IN OFFICE UNTIL THE 2026 ANNUAL MEETING

|

Management

Director Since: 2018

Age: 61

Board Committee(s):

• None

|

Carrie L. Bourdow

Ms. Bourdow was appointed President, Chief Executive Officer, and member of the Trevena Board of Directors in October 2018, and as Chair of the Board in November 2023. She has served in various senior

positions at Trevena since May 2015. She joined the Company as Chief Commercial Officer and was appointed Executive Vice President and Chief Operating Officer in January 2018. Prior to joining Trevena, Ms. Bourdow was Vice President of

Marketing at Cubist Pharmaceuticals, Inc., from 2013 until its acquisition by Merck & Co. (MRK), Inc. in January 2015. At Cubist, Ms. Bourdow led launch strategy, marketing, reimbursement, and operations for five acute care hospital

pharmaceuticals totaling over $1 billion in annual revenues. Prior to Cubist, Ms. Bourdow served for more than 20 years at Merck & Co., Inc., where she held positions of increasing responsibility across multiple therapeutic areas. Ms.

Bourdow previously served as a member of the board of directors for Sesen Bio from February 2020 until March 2023 and as a member of the board of directors for Nabriva Therapeutics plc. (NBRV) from June 2017 until July 2023.