Exhibit 99.1

Trevena, Inc. Reports Fourth Quarter

and Full Year 2020 Results

--

OLINVYK™ approved in U.S.; customer-facing

teams now fully deployed

Primary study completion for TRV027

in COVID-19 patients expected in 1H 2021

IND for TRV045 (S1P1 receptor

modulator) on track for 1H 2021; focus in epilepsy and neuropathic pain

Year-end cash of $109.4M funds operations

through YE 2022

--

Company to host conference call today,

March 9th, 2021, at 8:00 a.m. ET

--

CHESTERBROOK,

PA., Mar. 9, 2021 (GLOBE NEWSWIRE) -- Trevena, Inc. (Nasdaq: TRVN), a biopharmaceutical company focused on

the development and commercialization of novel medicines for patients with central nervous system (CNS) disorders, today

reported its financial results for the fourth quarter and full year ended December 31, 2020, and provided an overview of its

2020 and 2021 year-to-date operational highlights.

“2020 was a year of unprecedented

achievement for Trevena. We secured U.S. approval of OLINVYK, laid the groundwork for a successful field launch, and partnered

with leading institutions to significantly advance our pipeline – all while navigating the challenges that COVID-19 posed

to our industry and our communities,” said Carrie Bourdow, President and Chief Executive Officer of Trevena, Inc. “We

enter 2021 with focus and resilience, as we look to deliver a successful first year of launch for OLINVYK and achieve multiple

milestone events across our pipeline.”

2020 and 2021 YTD Corporate Highlights:

OLINVYK™ (oliceridine) injection

Milestones

| · | Obtained FDA approval and DEA scheduling. In August 2020, the U.S. FDA approved

OLINVYK in adults for the management of acute pain severe enough to require an intravenous opioid analgesic and for whom alternative

treatments are inadequate. In October 2020 the U.S. DEA classified oliceridine as a Schedule II controlled substance. |

The Company is reiterating its

commitment to the ethical promotion of OLINVYK. OLINVYK is a novel and differentiated alternative to existing IV analgesics. In

those patients for whom an IV opioid is necessary to manage their acute pain, the Company’s goal is to replace conventional

IV opioids, not to increase opioid usage.

| · | Launched commercial and field medical teams in February. The Company today announced it

has recently completed full deployment of its customer-facing team, including Medical Science Liaisons, Regional Sales Managers,

Key Account Managers, and sales representatives. Multiple institutions and ambulatory surgery centers are in the process of reviewing

OLINVYK for formulary inclusion. The Company has set a target of 100 formulary acceptances by year-end. |

| · | Completed foundational launch activities. Following DEA scheduling, the Company made OLINVYK

commercially available across all three vial presentations (1 mg/1 mL and 2 mg/2 mL single-dose vials; 30 mg/30 mL single-patient-use

vials for patient-controlled analgesia) and announced contracts in place with the three major wholesalers covering the majority

of the acute care business. |

In January 2021, the Company

completed a comprehensive product dossier for OLINVYK, including head-to-head data versus IV morphine and health economic models,

for use by hospital formulary committees. The Company also finalized all J- and C-code submissions with the Centers for Medicare

and Medicaid (CMS) and completed market access resources for customers to facilitate reimbursement of OLINVYK.

| · | Continued to expand body of published peer-reviewed literature. In 2020, the Company

announced four new publications of OLINVYK data, with the number of publications from the development program now totaling 24.

These findings provide additional insight into the differentiated safety and tolerability profile of OLINVYK and are available

to healthcare providers as they consider the use of OLINVYK in their patients. |

| · | Supported development progress made by ex-U.S. partner. In June 2020, the Company announced

that Jiangsu Nhwa Pharmaceutical Co., its partner in China, was approved by the Chinese National Medical Products Administration

(NMPA) to initiate clinical trials for OLINVYK. Jiangsu Nhwa holds an exclusive license agreement for the development and commercialization

of OLINVYK in China. |

Pipeline Milestones

| · | Announced new pipeline asset: TRV027 for COVID-19 patients. In June 2020, the Company

entered into a collaboration with Imperial College London (ICL) to investigate TRV027, a novel AT1 receptor selective

agonist, as a potential treatment for acute lung damage / abnormal clotting associated with COVID-19. TRV027’s mechanism

of action received significant scientific interest, including a publication in Circulation, highlighting its hypothesized

reparative effects in the lungs and other major organs. |

ICL initiated a 60-person study

with a primary objective of assessing the effect of TRV027 on abnormal clotting in COVID-19 patients. ICL expects the primary completion

date to be in 1H 2021.

| · | Commenced partnership with NIH to evaluate TRV045 for epilepsy and chronic neuropathic pain;

IND filing on track for 1H 2021. In March 2020, the Company announced that the National Institutes of Health (NIH) had

begun evaluating TRV045, a novel S1P receptor modulator in nonclinical animal models, as a potential treatment for epilepsy. In

May 2020, NIH also began evaluating TRV045 in nonclinical animal models as a treatment for various pain conditions, including

inflammatory and neuropathic pain. Data demonstrating efficacy in animal models of neuropathic pain and epilepsy were presented

in December 2020 at the 59th Annual Meeting for the American College of Neuropsychopharmacology (ACNP). |

| · | Identified novel oral dose formulation for delta receptor selective agonist, TRV250. The

Company today announced that following the pause of clinical activity in 2020 due to COVID-19, it advanced formulation work for

TRV250 that has yielded a novel oral dose form. This differentiated formulation could extend the Company’s market exclusivity

an additional five years to 2041. The Company has initiated IND-enabling activities with this oral dosage form, which it believes

offers significant advantages for exploring multiple CNS disease states. |

Financial Milestones

| · | Strengthened balance sheet. The Company significantly bolstered its financial position

in 2020, including a successful $57.5 million public offering of common stock following approval of OLINVYK, and receipt of a $3

million milestone payment from its partner in China in connection with this approval. The Company today reported $109.4 million

in cash and cash equivalents as of December 31, 2021. |

Financial Results

for Fourth Quarter and Full Year 2020

For the fourth

quarter of 2020, the Company reported a net loss attributable to common stockholders of $11.9 million, or $0.08 per share, compared

to $6.4 million, or $0.07 per share, for the fourth quarter of 2019. For the full year ended December 31, 2020, net loss

attributable to common stockholders was $29.4 million, or $0.23 per share, compared to $24.9 million, or $0.27 per share, for the

year ended December 31, 2019. This increase is primarily due to activities in preparation for commercial launch of OLINVYK.

Cash and cash

equivalents were $109.4 million as of December 31, 2020, which the Company believes will be sufficient to fund the Company’s

operating expenses and capital expenditure requirements through the fourth quarter of 2022.

Conference

Call and Webcast Information

The Company will

host a conference call and webcast with the investment community on March 9, 2021, at 8:00 a.m. Eastern Time featuring

remarks by Carrie Bourdow, President and Chief Executive Officer, Bob Yoder, Senior Vice President and Chief Commercial Officer,

Mark Demitrack, M.D., Senior Vice President and Chief Medical Officer, Barry Shin, Senior Vice President and Chief Financial Officer,

and Gregory Hammer, M.D., Professor of Anesthesiology, Stanford University Medical Center.

| Title: |

Trevena Fourth Quarter 2020 & Full Year 2019 Financial Results Conference Call and Webcast |

| Date: |

Tuesday, March 9, 2021 |

| Time: |

8:00 a.m. ET |

| Conference Call Details: |

Toll-Free: (855) 465-0180

International: (484) 756-4313

Conference ID: 7276985 |

| Webcast: |

https://www.trevena.com/investors/events-presentations/ir-calendar |

About OLINVYK™ (oliceridine) injection

OLINVYK

is a new chemical entity approved by the FDA in August 2020. OLINVYK contains oliceridine, a Schedule II controlled substance

with a high potential for abuse similar to other opioids. It is indicated in adults for the management of acute pain severe enough

to require an intravenous opioid analgesic and for whom alternative treatments are inadequate. OLINVYK is available in 1 mg/1

mL and 2 mg/2 mL single-dose vials, and a 30 mg/30 mL single-patient-use vial for patient-controlled analgesia (PCA). Approved

PCA doses are 0.35 mg and 0.5 mg and doses greater than 3 mg should not be administered. The cumulative daily dose should not

exceed 27 mg. Please see Important Safety Information, including the BOXED WARNING, and full prescribing information at www.OLINVYK.com.

About Trevena

Trevena, Inc. is a biopharmaceutical

company focused on the development and commercialization of novel medicines for patients with CNS disorders. The Company has one

approved product in the United States, OLINVYK™ (oliceridine) injection, indicated in adults for the management of acute

pain severe enough to require an intravenous opioid analgesic and for whom alternative treatments are inadequate. The Company also

has four novel and differentiated investigational drug candidates: TRV250 for the acute treatment of migraine, TRV734 for maintenance

treatment of opioid use disorder, and TRV027 for acute lung injury / abnormal blood clotting in COVID-19 patients. The Company

has also identified TRV045, a novel S1P receptor modulator that may offer a new approach to treating a variety of CNS disorders.

For

more information, please visit www.Trevena.com

Forward-Looking Statements

Any statements in this press release about

future expectations, plans and prospects for the Company, including statements about the Company’s strategy, future operations,

clinical development and trials of its therapeutic candidates, plans for potential future product candidates, commercialization

of approved drug products and other statements containing the words “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “objective,”

“predict,” “project,” “suggest,” “target,” “potential,” “will,”

“would,” “could,” “should,” “continue,” “ongoing,” or the negative

of these terms or similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation

Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of

various important factors, including: the commercialization of any approved drug product, the status, timing, costs, results and

interpretation of the Company’s clinical trials or any future trials of any of the Company’s investigational drug candidates;

the uncertainties inherent in conducting clinical trials; expectations for regulatory interactions, submissions and approvals,

including the Company’s assessment of the discussions with the FDA or other regulatory agencies about any and all of its

programs; uncertainties related to the commercialization of OLINVYK; available funding; uncertainties related to the Company’s

intellectual property; uncertainties related to the ongoing COVID-19 pandemic, other matters that could affect the availability

or commercial potential of the Company’s therapeutic candidates; and other factors discussed in the Risk Factors set forth

in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange

Commission (SEC) and in other filings the Company makes with the SEC from time to time. In addition, the forward-looking statements

included in this press release represent the Company’s views only as of the date hereof. The Company anticipates that subsequent

events and developments may cause the Company’s views to change. However, while the Company may elect to update these forward-looking

statements at some point in the future, it specifically disclaims any obligation to do so, except as may be required by law.

For more information, please contact:

Investor Contact:

Dan Ferry

Managing Director

LifeSci Advisors, LLC

daniel@lifesciadvisors.com

(617) 430-7576

Company Contact:

Bob Yoder

SVP and Chief Commercial Officer

Trevena, Inc.

(610) 354-8840

|

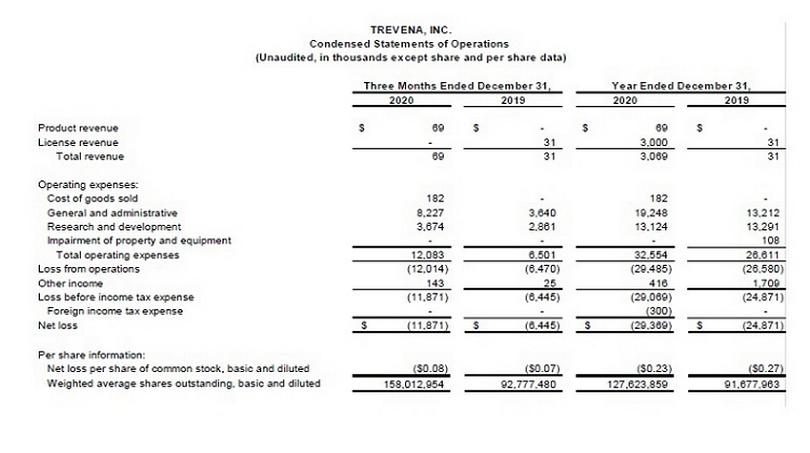

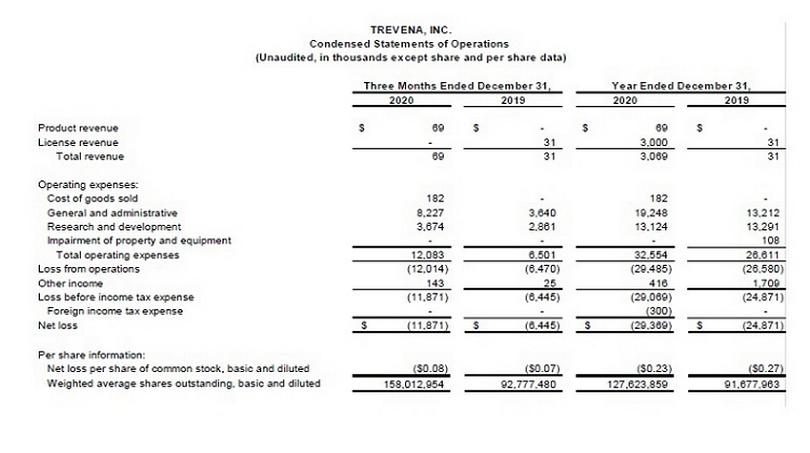

TREVENA,

INC.Condensed Statements of Operations (Unaudited, in thousands except share and per share data) Three

Months Ended December 31,Year Ended December 31, 2020 2019 2020 2019 Product revenue 69$ -$ 69$ -$

License revenue - 313,00031Total revenue69313,06931Operating expenses:Cost of goods sold182- 182- General

and administrative 8,2273,64019,24813,212Research and development 3,6742,86113,12413,291Impairment

of property and equipment- - - 108 Total operating expenses 12,0836,50132,55426,611Loss from operations

(12,014)(6,470)(29,485)(26,580)Other income143254161,709Loss before income tax expense(11,871)(6,445)(29,069)(24,871)Foreign

income tax expense- - (300) - Net loss(11,871)$ (6,445)$ (29,369)$ (24,871)$ Per share information:Net

loss per share of common stock, basic and diluted ($0.08)($0.07)($0.23)($0.27)Weighted average shares

outstanding, basic and diluted 158,012,95492,777,480127,623,85991,677,963 |

|

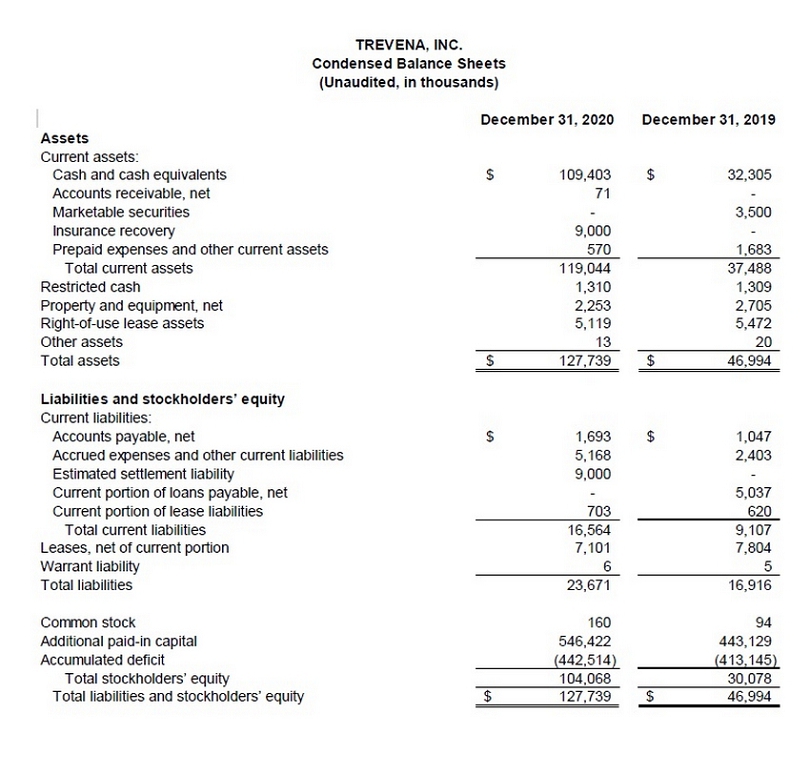

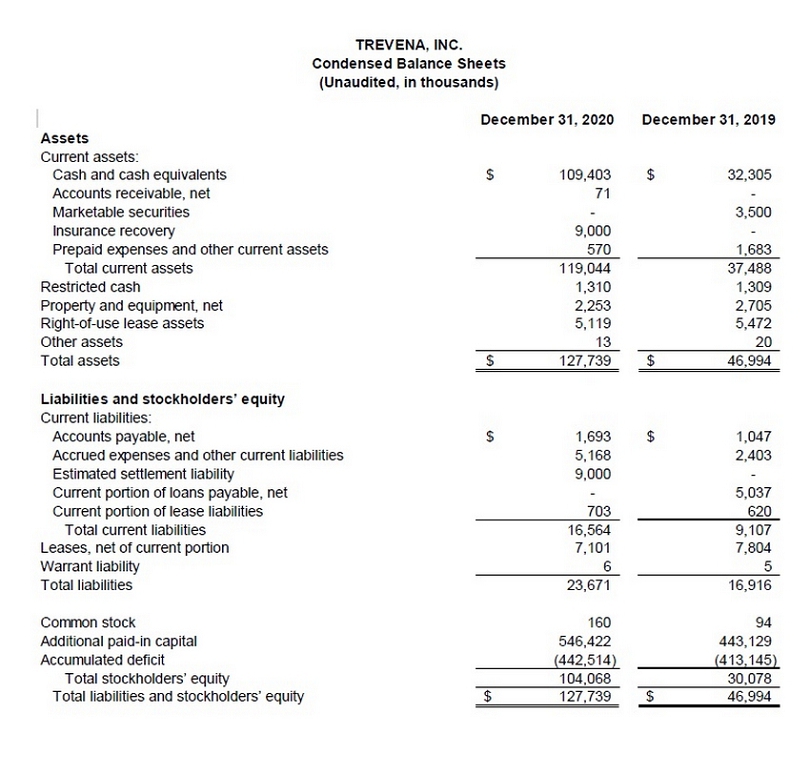

TREVENA,

INC.Condensed Balance Sheets(Unaudited, in thousands) December 31, 2020December 31, 2019AssetsCurrent

assets:Cash and cash equivalents 109,403$ 32,305$ Accounts receivable, net71- Marketable securities-

3,500Insurance recovery9,000- Prepaid expenses and other current assets 5701,683Total current assets

119,04437,488Restricted cash 1,3101,309Property and equipment, net 2,2532,705Right-of-use lease assets5,119

5,472 Other assets13 20 Total assets 127,739$ 46,994$ Liabilities and stockholders’ equity Current

liabilities:Accounts payable, net1,693$ 1,047$ Accrued expenses and other current liabilities 5,1682,403Estimated

settlement liability9,000- Current portion of loans payable, net - 5,037Current portion of lease liabilities703620

Total current liabilities 16,5649,107Leases, net of current portion7,1017,804Warrant liability 65Total

liabilities 23,67116,916Common stock 16094Additional paid-in capital546,422443,129Accumulated deficit(442,514)(413,145)Total

stockholders’ equity 104,06830,078Total liabilities and stockholders’ equity127,739$ 46,994$ |