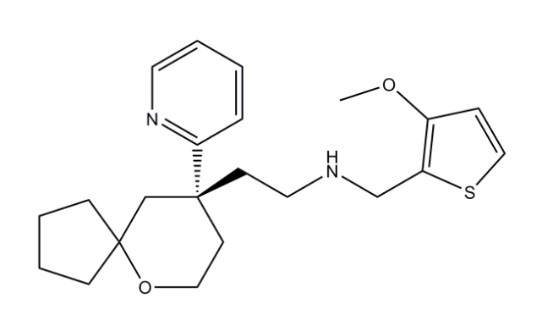

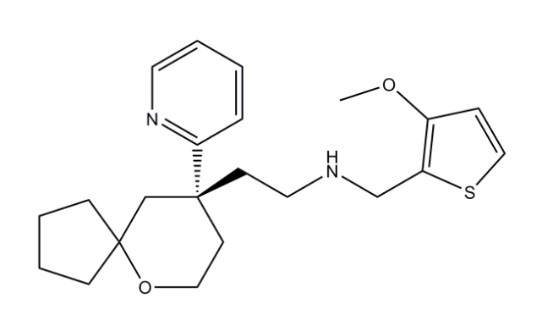

Schedule 1.01(a)

Chemical Structure

Exhibit 10.2

CERTAIN CONFIDENTIAL INFORMATION IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE IT IS BOTH (I) NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED.

REVENUE INTEREST PURCHASE AGREEMENT

by and between

as Seller,

and

Trevena SPV2 LLC,

as Company

REVENUE INTEREST PURCHASE AGREEMENT

This REVENUE INTEREST PURCHASE AGREEMENT (this “Agreement”), dated as of March 30, 2022, is entered into between TREVENA, INC., a Delaware corporation (together with its permitted successors and assigns, “Seller”), and Trevena SPV2 LLC, a Delaware limited liability company (together with its permitted successors and assigns, “Company”).

RECITALS

WHEREAS, Seller owns 100% of the equity interests of Company;

WHEREAS, Seller desires to sell, contribute, assign, transfer, convey and grant to Company all its right, title and interest in, to and under the Purchased Revenue Interest and the Purchased Additional Revenue Interest;

WHEREAS, in consideration for such sale, contribution, assignment, transfer, conveyance and grant to Company, Company shall pay to Seller the Purchase Price on the Initial Funding Date;

WHEREAS, Company desires to purchase, acquire, receive and accept from Seller all of Seller’s right, title and interest in, to and under the Purchased Revenue Interest and the Purchased Additional Revenue Interest pursuant to this Agreement and in consideration, commits to pay the Purchase Price on the Initial Funding Date to Seller and reflect the excess value of the aggregate amount of the Purchased Revenue Interest and the Purchased Additional Revenue Interest over the Purchase Price as a capital contribution to Company from Seller, under and subject to the terms of this Agreement;

NOW, THEREFORE, in consideration of the mutual covenants contained herein, and other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, the parties hereto agree as follows:

As used herein, the following terms have the following respective meanings:

“Additional Applicable Rate” means initially zero percent (0.0%); provided that if this Agreement is terminated with respect to the Purchased Revenue Interest, as set forth in Section 5.01 of this Agreement, such rate shall be increased to four percent (4.0%), such that the sum of the Additional Applicable Rate and the Applicable Rate shall never be less than four percent (4%).

“Agreement” has the meaning set forth in the Preamble.

-2-

“Applicable Rate” means four percent (4.0%); provided that if the first Chinese Regulatory Approval has not occurred on or prior to [***], such rate shall be increased to seven percent (7.0%) for the period beginning on [***] and ending on the date (if any) on which the Applicable Rate Step-Up Termination Trigger occurs.

“Applicable Rate Step-Up Termination Trigger” means such time as the Lender has received payments under the Loan Agreement pursuant to Section 4.04 thereof equal to, in the aggregate, the product of (a) [***] multiplied by (b) the sum of the First Tranche Loan Commitment, the Second Tranche Loan Commitment (if the Second Tranche Loan has been extended under the Loan Agreement) and the Third Tranche Loan Commitment (if the Third Tranche Loan has been extended under the Loan Agreement) (collectively, the “Facility Amount”); provided that if the first Chinese Regulatory Approval occurs on or prior to [***], such product shall be decreased as of the date of the first Chinese Regulatory Approval to the product of (a) [***] multiplied by (b) the Facility Amount.

“Chinese Regulatory Approval” means any and all approvals, licenses, registrations or authorizations of any Regulatory Agency (including NMPA) necessary for commercially distributing, selling, promoting, marketing or otherwise Commercializing the Licensed Product in the People’s Republic of China, including pricing and reimbursement approvals where reasonably necessary for the sale of the Licensed Product.

“Combination Product” means a product that includes Compound and at least one additional active ingredient and is either co-formulated, co-administered or sold at a single price point or otherwise sold to be administered together, sequentially or as part of a course of treatment. Drug delivery vehicles, adjuvants, solubilizers and excipients shall not be deemed to be “active ingredients”, except in the case where such delivery vehicle, adjuvant, solubilizers, or excipient is recognized as an active ingredient in accordance with applicable FDA regulations.

“Commercialization” means any and all activities directed to the distribution, marketing, detailing, promotion, selling and securing of reimbursement of the Revenue Interest Product (including the selling and offering for sale of the Revenue Interest Product), and shall include post-approval studies to the extent required by a Regulatory Agency, promoting, detailing, distributing, selling the Revenue Interest Product, importing, exporting or transporting the Revenue Interest Product for sale, and regulatory compliance with respect to the foregoing.

“Company” has the meaning set forth in the Preamble.

“Compound” means (i) oliceridine having the chemical structure set forth on Schedule 1.01(a) hereto, (ii) a prodrug or metabolite of the compound specified in (i), and (iii) any salt, polymorph, solvate, hydrate, anhydride, stereoisomer, racemate, acid, base or ester forms of the compound specified in (i).

“Default” means any condition or event which constitutes a Seller Event of Default or which, with the giving of notice or the lapse of time or both (in each case to the extent described in the relevant subclauses of the definition of “Seller Event of Default”) would, unless cured or waived, become a Seller Event of Default.

“Effective Date” means the date hereof.

-3-

“GAAP” means the generally accepted accounting principles in the United States of America in effect from time to time.

“Indemnified Party” has the meaning set forth in Section 6.01(a).

“Initial Funding Date” means the date the First Tranche Loan is made by Lender to Borrower pursuant to Section 2.01(a) of the Loan Agreement.

“Lender” means R-Bridge Investment Four Pte. Ltd., a Singapore private company limited.

“Licensed Product” has the meaning assigned to such term in Section 1.49 of the License Agreement.

“Loan Agreement” means that certain Loan Agreement dated as of March 30, 2022 by and between Lender and Company.

“NMPA” means National Medicine Products Administration of China (formerly known as the China Food and Drug Administration), or its successor.

“Out-License” means any license or other agreement between Seller (or any of its Affiliates) and any Third Party (including any Permitted License with a Third Party) pursuant to which Seller (or any of its Affiliates) grants to such Third Party a license or sublicense under, or other rights to, any portion of the Intellectual Property to promote, market, sell, offer for sale or import the Revenue Interest Product in the United States; provided, however, that “Out-License” shall not include agreements granting non-exclusive rights under the Intellectual Property entered into in the ordinary course of business, including distribution agreements, manufacturing agreements, material transfer agreements and consulting agreements, that, in all cases, do not grant any rights to promote, market, sell, offer for sale or otherwise Commercialize any Revenue Interest Product.

“Permitted License” is defined in Section 4.01(q)(ii)(A).

“Permitted Licensee” is defined in Section 4.01(q)(ii)(A).

“Purchase Price” [***].

“Purchased Additional Revenue Interest” means, with respect to any Calendar Quarter commencing on or after the Closing Date and ending on the earlier to occur of (i) the occurrence of an Event of Default pursuant to the Loan Agreement and (ii) the written termination of this Agreement by Seller and Company, an undivided ownership interest of Net Sales, in an amount equal to the product of (a) the aggregate Net Sales in such Calendar Quarter of the Revenue Interest Product and (b) the Additional Applicable Rate for such Calendar Quarter.

“Purchased Revenue Interest” means, with respect to any Calendar Quarter commencing on or after the Closing Date and ending on the Termination Date, an undivided

-4-

ownership interest of Net Sales, in an amount equal to the product of (a) the aggregate Net Sales in such Calendar Quarter of the Revenue Interest Product and (b) the Applicable Rate for such Calendar Quarter.

“Purchased Revenue Interest Cap” means Ten Million Dollars ($10,000,000) minus any amounts paid to Lender from the Interest Reserve Account pursuant to Section 4.04 of the Loan Agreement in respect of Fixed Interest Payments payable to Lender.

“Quarterly Report” means, with respect to each Calendar Quarter, a written report setting forth in reasonable detail (i) the calculation of the Purchased Revenue Interest and the Purchased Additional Revenue Interest for such Calendar Quarter, identifying the number of units of the Revenue Interest Product sold by Seller and its Affiliates and Permitted Licensees during such Calendar Quarter and setting forth a detailed break-down of all permitted deductions from gross sales used to determine Net Sales, (ii) Net Sales for such Calendar Quarter, and (iii) the cumulative year-to-date aggregate Net Sales of the Revenue Interest Product through the end of such Calendar Quarter.

“Recharacterization” has the meaning set forth in Section 2.04(b).

“Revenue Interest Product” means, collectively (a) the product known as OLINVYK® (oliceridine) and (b) any other product that contains the Compound as an active ingredient, alone or in combination with another active component, in each case of (a) and (b), in any strengths, forms, formulations, administrations or delivery routes.

“Seller” has the meaning set forth in the Preamble.

“Seller Event of Default” means the occurrence of one or more of the following:

-5-

“Termination Date” means the earlier of (a) the date that payments received by Company in respect of the Purchased Revenue Interest (excluding payments received by Company in accordance with Section 4.01(n)) equal the Purchased Revenue Interest Cap and (b)

-6-

the date on which the Company has paid to Lender, in accordance with Section 3.03 of the Loan Agreement, an Applicable Change of Control Payment calculated in accordance with Section 3.03(b) of the Loan Agreement.

-7-

-8-

-9-

-10-

-11-

-12-

-13-

-14-

-15-

-16-

-17-

-18-

-19-

Seller:

Trevena, Inc.

955 Chesterbrook Blvd

Suite 110

Chesterbrook, PA 19087

Attention: Barry Shin; Joel Solomon

Email: bshin@trevena.com; jsolomon@trevena.com

With a copy (which shall not constitute notice) to:

Troutman Pepper Hamilton Sanders LLP

Two Logan Square,

Eighteenth and Arch Streets,

Philadelphia, PA 19103

Attention: Brian Katz; Charles Charpentier; Timothy Atkins

Email: Brian.Katz@troutman.com; Charles.Charpentier@troutman.com; Timothy.Atkins@Troutman.com

Company:

Trevena SPV2 LLC

955 Chesterbrook Blvd

Suite 110

Chesterbrook, PA 19087

Attention: Barry Shin; Joel Solomon

Email: bshin@trevena.com; jsolomon@trevena.com

With a copy (which shall not constitute notice) to:

Troutman Pepper Hamilton Sanders LLP

Two Logan Square,

-20-

Eighteenth and Arch Streets,

Philadelphia, PA 19103

Attention: Brian Katz; Charles Charpentier; Timothy Atkins

Email: Brian.Katz@troutman.com; Charles.Charpentier@troutman.com; Timothy.Atkins@Troutman.com

Lender:

R-Bridge Investment Four Pte. Ltd.

[***]Attention: Peng Fu; Oak Ma

Email: [***]

With a copy (which shall not constitute notice) to:

Goodwin Procter LLP

100 Northern Avenue

Boston, MA 02210

Attention: Arthur McGivern; Wendy Pan; Christopher W. Steinroeder

E-mail: amcgivern@goodwinlaw.com; wpan@goodwinlaw.com; CSteinroeder@goodwinlaw.com

or at other such address as shall be designated by such party in a written notice to the other parties. Notice shall be effective and deemed received (a) two (2) days after being delivered to the courier service, if sent by courier, (b) upon receipt of confirmation of transmission, if sent by telecopy, or (c) when delivered, if delivered by hand.

Wherever notice or a report is required to be given or delivered to Company, a copy of such notice or report shall also be given or delivered concurrently to Lender.

-21-

Date, Lender (provided that, deemed assignments resulting from a change in the beneficial ownership of Seller shall not require consent of Lender).

-22-

enforce the provisions of this Agreement against the parties hereto. In addition, the parties hereto acknowledge that Lender is entitled under the Loan Documents to make claims directly to Seller for indemnities in favor of Company, without prejudice to its rights as an Indemnified Party hereunder, and that nothing herein limits the rights of Lender under the Security Agreement, the Parent Guarantee or Stock Pledge Agreement, which rights may, in each case, be exercised in Lender’s sole discretion from time to time whether or not it has exercised or is then exercising its rights as a third party beneficiary or its rights and remedies under Applicable Law.

[Remainder of page intentionally left blank]

-23-

IN WITNESS WHEREOF, Seller and Company have caused this Agreement to be duly executed by their respective officers as of the day and year first above written.

By:/s/ Barry Shin

Name: Barry Shin

Title: Senior Vice President and Chief

Financial Officer

Trevena SPV2 LLC,

as Company

By:/s/ Barry Shin

Name: Barry Shin

Title: Treasurer

[Signature Page to Revenue Interest Purchase Agreement]

Schedule 1.01(a)

Chemical Structure