EX-10.12

Published on March 8, 2017

Exhibit 10.12

AGREEMENT OF LEASE

BETWEEN

CHESTERBROOK PARTNERS, LP

AND

TREVENA, INC.

SUITE 200

955 CHESTERBROOK BOULEVARD

CHESTERBROOK CORPORATE CENTER®

TREDYFFRIN TOWNSHIP

CHESTER COUNTY

PENNSYLVANIA

TABLE OF CONTENTS

|

1. |

|

Parties |

|

1 |

|

2. |

|

Demise |

|

1 |

|

3. |

|

Term |

|

1 |

|

4. |

|

Fixed Rent; Tenant Energy Costs; Annual Operating Costs; Taxes |

|

2 |

|

5. |

|

Covenant to Pay Rent and Additional Rent; Late Charge |

|

10 |

|

6. |

|

Use |

|

11 |

|

7. |

|

Assignment and Subletting |

|

11 |

|

8. |

|

Condition of Premises; Improvement of the Premises |

|

14 |

|

9. |

|

Alterations |

|

20 |

|

10. |

|

Rules and Regulations |

|

20 |

|

11. |

|

Fire or Other Casualty |

|

21 |

|

12. |

|

Landlord’s Right to Enter |

|

22 |

|

13. |

|

Insurance |

|

22 |

|

14. |

|

Repairs and Condition of Premises |

|

23 |

|

15. |

|

Compliance with Law |

|

24 |

|

16. |

|

Services |

|

25 |

|

17. |

|

Notice of Breakage, Fire, Theft |

|

28 |

|

18. |

|

Indemnification; Release |

|

28 |

|

19. |

|

Mechanics’ and Other Liens |

|

29 |

|

20. |

|

Default by Landlord |

|

30 |

|

21. |

|

Defaults – Remedies |

|

30 |

|

22. |

|

Remedies Cumulative |

|

34 |

|

23. |

|

Excepted from Premises |

|

35 |

|

24. |

|

Lease Subordinated |

|

35 |

|

25. |

|

Condemnation |

|

36 |

|

26. |

|

Force Majeure |

|

36 |

|

27. |

|

Notices |

|

37 |

|

28. |

|

Definition of “the Landlord” |

|

38 |

|

29. |

|

Definition of “the Tenant” |

|

38 |

|

30. |

|

Estoppel Certificate; Mortgagee Lease Comments |

|

38 |

|

31. |

|

Severability |

|

39 |

|

32. |

|

Miscellaneous |

|

40 |

|

33. |

|

Brokers |

|

41 |

|

34. |

|

Security Deposit |

|

41 |

|

35. |

|

Quiet Enjoyment |

|

42 |

|

36. |

|

Rights of Mortgage Holder |

|

42 |

|

37. |

|

Whole Agreement |

|

43 |

|

38. |

|

Financial Statements |

|

43 |

|

39. |

|

Option to Extend Term |

|

43 |

|

40. |

|

Expansion Option |

|

44 |

|

41. |

|

Right of First Offer |

|

45 |

|

42. |

|

Vent Installation |

|

47 |

|

43. |

|

Generator and Air Handling Unit |

|

48 |

|

44. |

|

Tenant’s Property |

|

49 |

i

EXHIBITS

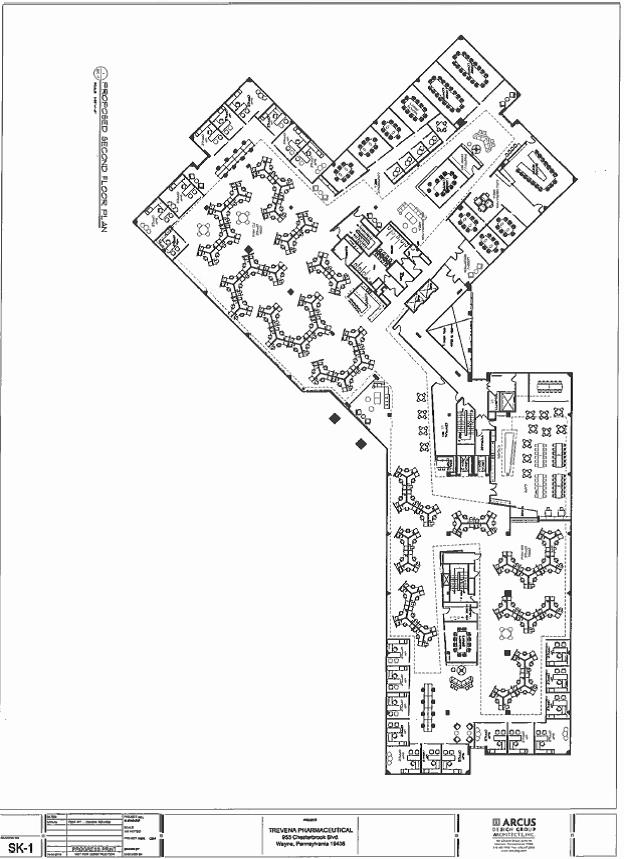

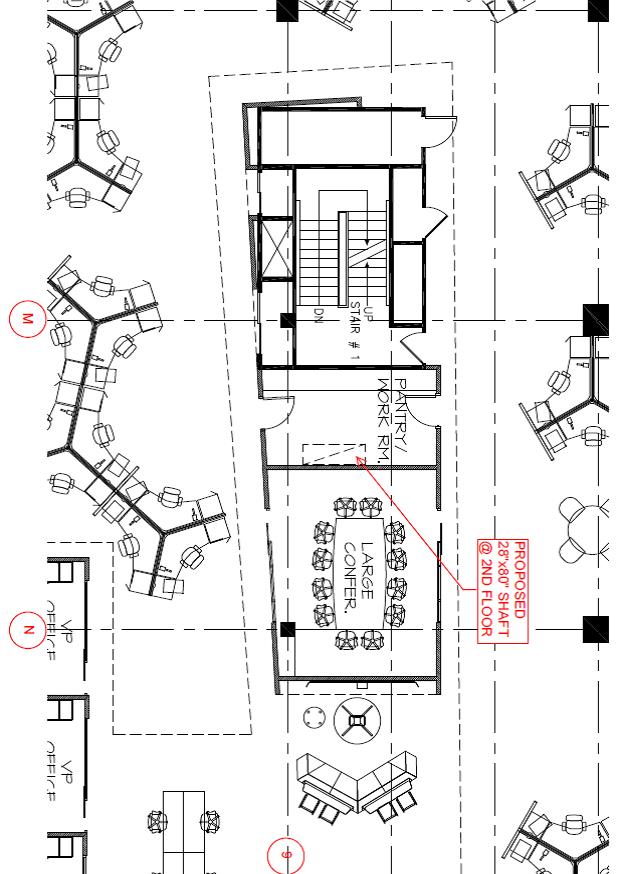

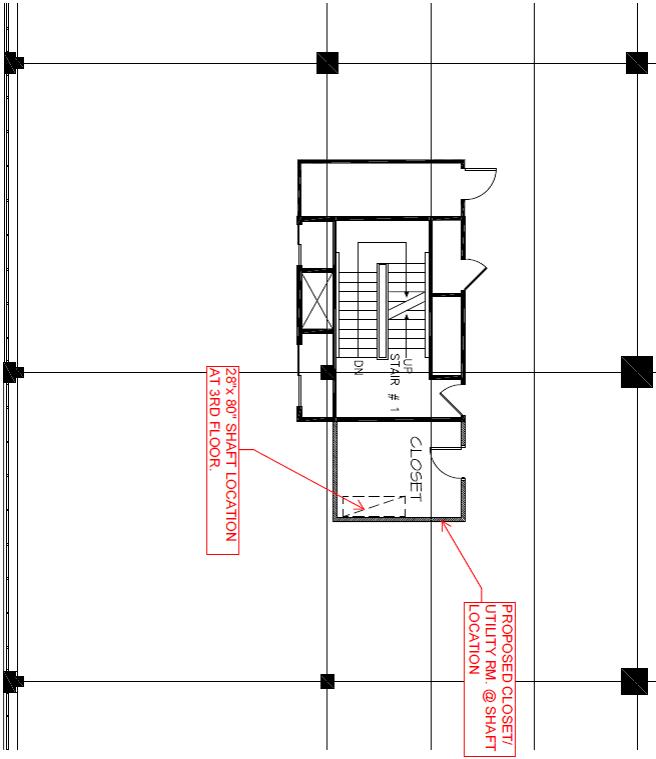

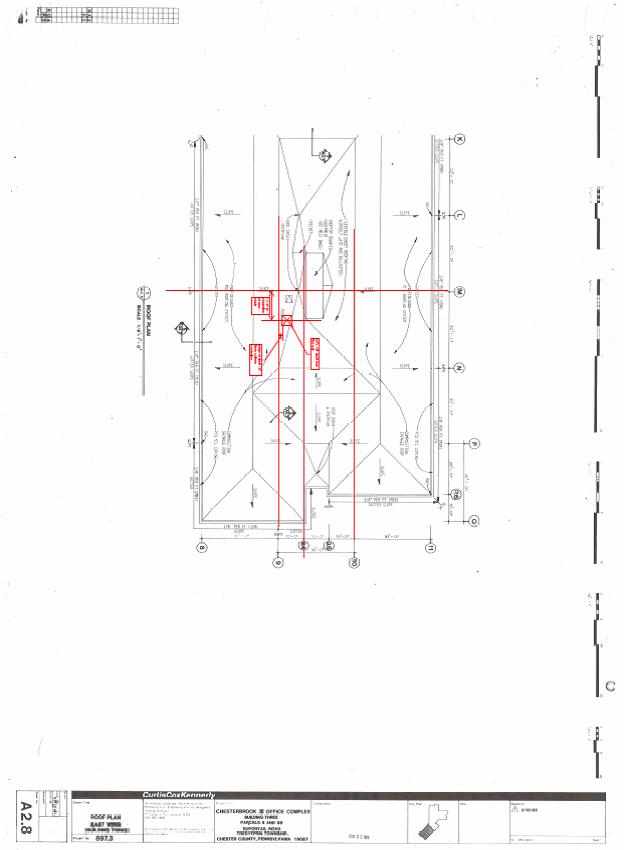

“A” — Floor Plan

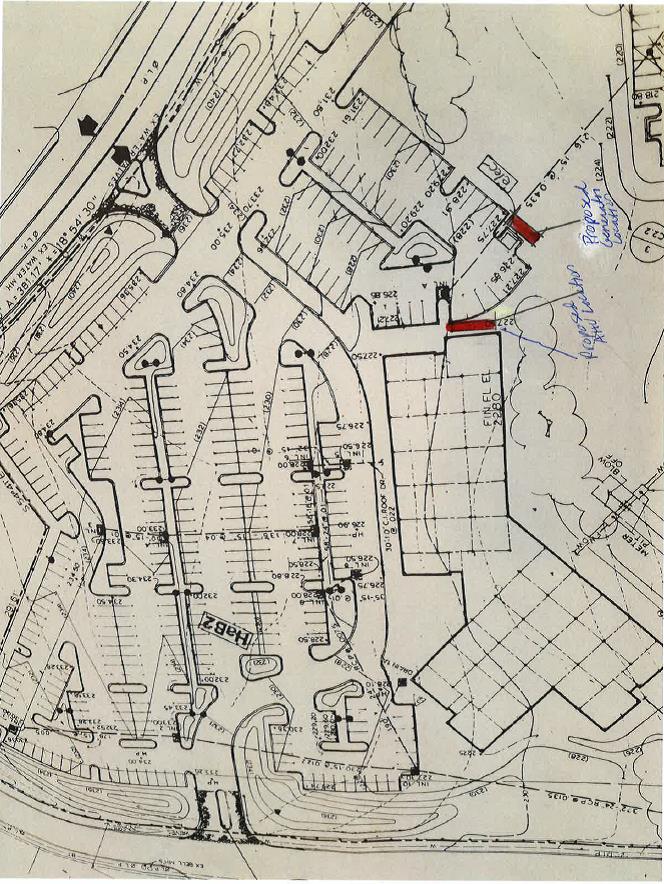

“B” — Description of the Land

“C” — Memorandum of Commencement Date

“D” — Early Access By Tenant

“E” — Rules and Regulations

“F” — Cleaning Specifications

“G” —Letter of Credit Requirements

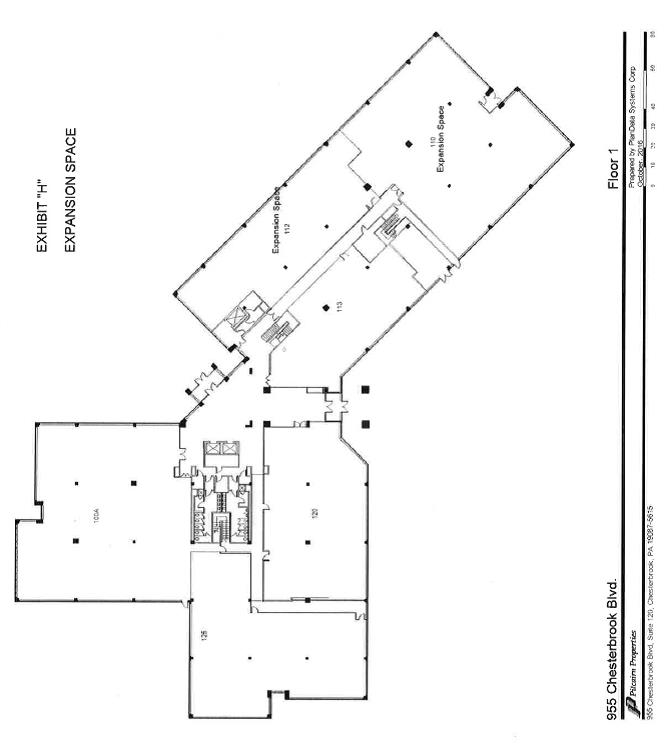

“H” — Expansion Spaces

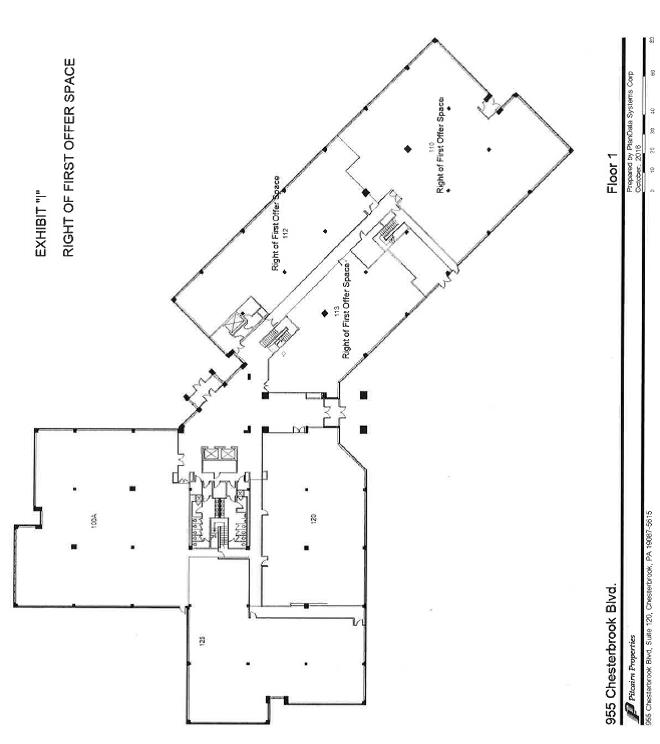

“I” — RFO Space

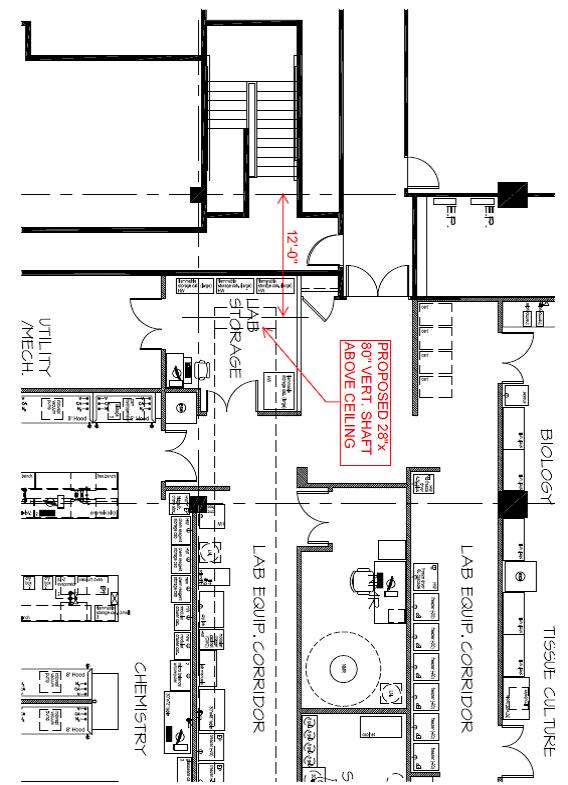

“J” — Ventilation Duct Location

“K” — Generator and AHU Locations

“L” — Form of Landlord Waiver

ii

AGREEMENT OF LEASE

1. Parties.

This Lease is made as of December 9, 2016, by and between CHESTERBROOK PARTNERS, LP, a limited partnership organized and existing under the laws of the State of Delaware, whose address is Suite 120, 955 Chesterbrook Boulevard, Wayne,

PA 19087 (hereafter called “Landlord”), and TREVENA, INC., a corporation organized and existing under the laws of the state of Delaware whose present address is 1018 W. 8th Avenue, King of Prussia, PA 19406 (hereinafter referred to as “Tenant”).

It is hereby agreed by and between Landlord and Tenant, intending to be legally bound, for themselves and for their respective heirs, executors, administrators, successors and assigns, in the manner following, it being understood that the Premises are demised under and subject to the following covenants, all of which are also to be regarded as strict legal conditions.

2. Demise.

Landlord does hereby lease and demise to Tenant and Tenant does hereby hire and take from Landlord, for the term and subject to the provisions hereof, the premises (the “Premises”) shown cross-hatched on the floor plan(s) (the “Floor Plan”) attached hereto as Exhibit “A,” consisting of approximately 40,565 rentable square feet on the second floor of the building (hereinafter referred to as the “Building”) known as 955 Chesterbrook Boulevard, occupying the parcel of land bounded as described on Exhibit “B” attached hereto (the “Land”), together with the right, in common with others, to use the common areas of the Property. The Building and Land are sometimes collectively referred to in this Lease as the “Property”. As used herein, “common areas” means those portions of the Property that are designated by Landlord for the common use of tenants and others, such as sidewalks, unreserved parking areas, common corridors, elevator foyers, restrooms, vending areas and lobby areas, entrances, freight and passenger elevators, loading docks, public and private fire stairways, lobby areas and other public portions of the Property which enable Tenant to obtain full use and enjoyment and the Property for all customary purposes.

3. Term.

(a) This demise shall be for the term (hereinafter referred to as the “Term”) beginning on the “Commencement Date” of the Term as defined in Article 3(b) of this Lease and ending, without the necessity of notice from either party to the other, one hundred thirty (130) months from and after the Commencement Date if the Commencement Date shall be the first day of a month, if the Commencement Date shall be other than the first day of the month, then from and after the first day of the month next following the Commencement Date.

(b) The Commencement Date shall occur on the earlier of:

(i) Substantial Completion of the Tenant Improvements (as defined below), which date is anticipated by the parties to be July 1, 2017, or

(ii) the date Tenant or anyone claiming under or through Tenant first occupies any part of the Premises for business purposes (provided that Tenant accessing the Premises in accordance with this Lease in order to prepare the Premises for Tenant’s occupancy (including, without limitation, any move-in and/or fit-out work) shall not constitute occupying the Premises for purposes of this clause).

(c) When the Commencement Date is established, Landlord and Tenant shall promptly execute and acknowledge a memorandum, in the form attached hereto as Exhibit “C”, of the Commencement Date and the date of expiration of the Term (the “Expiration Date”).

(d) If the Tenant or any person claiming through the Tenant shall have continued to occupy the Premises after the expiration or earlier termination of the Term or any renewal thereof, and if the Landlord shall have consented in writing to such continuation of occupancy, such occupancy (unless the parties hereto shall have otherwise agreed in writing) shall be deemed to be under a month-to-month tenancy. The month-to-month tenancy shall continue until either party shall have notified the other in writing, at least thirty (30) days prior to the end of any calendar month, that the party giving such notice elects to terminate the month-to-month tenancy at the end of that calendar month, in which event, such tenancy shall so terminate. If such occupancy shall have continued without Landlord’s written consent, then such occupancy shall be in violation of this Lease, in which event, Tenant (i) shall be liable for any and all losses, claims, costs, expenses and damages actually suffered or incurred by Landlord (including, without limit thereto, court costs and reasonable counsel fees), whether foreseen or unforeseen as a result of such continued occupancy, and Landlord shall have all of the rights and remedies available under this Lease, or at law or in equity, for such violation and, without limitation of the foregoing clause (i), (ii) will indemnify and hold harmless Landlord from and against all claims and demands made by succeeding tenants against Landlord, founded upon delay by Landlord in delivering possession of the Premises to such succeeding tenant, provided that Landlord has given Tenant not less than thirty (30) days’ written notice that there is a tenant that will be succeeding to the Premises. The rental payable with respect to each monthly period of any month-to-month tenancy (and to each monthly period of continued occupancy which may occur without Landlord’s consent) shall equal one hundred fifty percent (150%) of the Fixed Rent payable under Article 4(b) paid for the immediately preceding lease year. Any month-to-month tenancy arising with Landlord’s consent shall be upon the same terms and subject to the same conditions as those which are set forth in this Lease, except as otherwise set forth in this subparagraph (f), provided that if the Landlord shall have given to the Tenant, at least thirty (30) days prior to the expiration or earlier termination of the Term or any renewal thereof or prior to the end of any month of a month-to-month tenancy, written notice that the Tenant’s occupancy following such month or expiration or termination (as the case may be) shall be subject to such modifications of the terms and conditions of this Lease (including any provision relating to the amount and payment of rent) as are specified in such notice, the Tenant’s occupancy following such month or expiration or termination (as the case may be) shall be subject to the provisions of this Lease as so modified.

4. Fixed Rent; Tenant Energy Costs; Annual Operating Costs; Taxes.

(a) Commencing on the Commencement Date, Tenant shall pay to Landlord as rent under this Lease the aggregate of:

2

(i) Fixed Rent (as defined in Article 4(b) of this Lease);

(ii) Tenant’s share of Tenant Energy Costs (as defined in Article 4(d) of this Lease);

(iii) Tenant’s proportionate share (as defined in Article 4(c) of this Lease) of increases in Annual Operating Costs (as defined in Article 4(e) of this Lease) over Base Operating Costs (as defined in Article 4(e)(iii) of this Lease);

(iv) Tenant’s proportionate share (as defined in Article 4(c) of this Lease) of increases in Annual Tax Costs (as defined in Article 4(f)(i) of this Lease) over Base Tax Costs (as defined in Article 4(f)(ii) of this Lease); and

(v) All other sums payable by Tenant to Landlord pursuant to the provisions of this Lease.

(b) Fixed Rent.

(i) The minimum fixed annual rent (the “Fixed Rent”) due each lease year of the Term shall be due and payable in lawful money of the United States of America, in equal monthly installments in advance and without prior demand, notice, set-off or deduction (except as otherwise expressly set forth in this Lease) on the first day of each and every month commencing on the Commencement Date and continuing during the Term in accordance with the following schedule:

|

Lease Months |

$/RSF (40,565) |

Annual Fixed Rent |

Monthly Fixed Rent |

|

1 — 12* |

$26.50 |

$1,074,972.50 |

$89,581.04 |

|

13 — 24* |

$27.00 |

$1,095,255.00 |

$91,271.25 |

|

25 — 36 |

$27.50 |

$1,115,537.50 |

$92,961.46 |

|

37 — 48 |

$28.00 |

$1,135,820.00 |

$94,651.67 |

|

49 — 60 |

$28.50 |

$1,156,102.50 |

$96,341.88 |

|

61 — 72 |

$29.00 |

$1,176,385.00 |

$98,032.08 |

|

73 — 84 |

$29.50 |

$1,196,667.50 |

$99,722.29 |

|

85 — 96 |

$30.00 |

$1,216,950.00 |

$101,412.50 |

|

97 — 108 |

$30.50 |

$1,237,232.50 |

$103,102.71 |

|

109 — 120 |

$31.00 |

$1,257,515.00 |

$104,792.92 |

|

121 — 130 |

$31.50 |

$1,277,797.50 |

$106,483.13 |

* The foregoing notwithstanding, Fixed Rent, but not Tenant Energy Costs, shall be conditionally and completely abated during the following ten (10) full calendar months of the Term: Lease Months 1 — 5; and Lease Months 13 — 17 (the “Rental Abatement Period”). During all other periods of the Term, Tenant shall make Fixed Rent payments without any abatement (except as otherwise expressly provided in this Lease) as provided herein.

Notwithstanding the foregoing, Landlord may, in Landlord’s sole discretion, prior to the conclusion of the Rental Abatement Period, elect to provide Tenant with a cash payment equal to any unused Abated Rent. If Landlord makes such election, Landlord shall provide Tenant written notice of such election prior to the conclusion of the Rental Abatement Period. In the event that Landlord elects to pay to Tenant such cash payment, provided Tenant has actually received the entire amount of the cash payment without setoff or deduction, Tenant shall pay the full Fixed Rent as set forth in the above rental chart without any abatement.

3

(ii) The Fixed Rent and all other sums payable to Landlord pursuant to or by reason of this Lease shall be payable to Landlord as follows:

If payment via check:

Chesterbrook Partners, L.P.

c/o Pitcairn Properties

955 Chesterbrook Boulevard — Suite 120

Chesterbrook, PA 19087

If paying via wire:

Bank of America, N.A.

ABA/Routing No. 026009593

Account Name: Chesterbrook Partners, L.P.

Account No. 0038-3050-5219

SWIFT Code: BOFAUS3N

If paying via ACH:

Bank of America, N.A.

ABA/Routing No. 031202084

Account Name: Chesterbrook Partners, L.P.

Account No. 0038-3050-5219

SWIFT Code: BOFAUS3N

or to such other person and at such other place as Landlord may from time to time designate in writing.

(iii) The first monthly installment of Fixed Rent (applicable to the sixth (6th) full month of the Term) shall be paid at the time of the signing of this Lease. The term “lease year” shall mean each annual period commencing on the Commencement Date and each succeeding anniversary thereof.

(iv) If the Term begins on a day other than the first day of a month, Fixed Rent from the Commencement Date until the first day of the following month shall be prorated and shall be payable in advance on the first day of the Term and, in such event, the installment of Fixed Rent paid at the signing of this Lease shall be applied to the Fixed Rent due for the sixth (6th) full calendar month of the Term.

(c) Tenant’s Proportionate Share. As used in this Lease, “the square foot area of the Premises” shall be deemed to be 40,565 square feet, “the total square foot area of the Building” shall be deemed to be 118,235 square feet and “Tenant’s proportionate share” shall refer to the percentage relationship between the foregoing, namely 34.31 %, subject to adjustment in accordance with this Lease in the event of a change in the square foot area of the Premises or the total square foot area of the Building. Tenant recognizes that, as used in this Lease, the total square foot area of the Premises includes a share of the common areas of the Building.

4

(d) Tenant Energy Costs.

(i) The term “Tenant Energy Costs” shall mean the actual costs (without markup but including Landlord’s reasonable administrative fee (currently $25.00 per month)) charged by the utility provider to Landlord of furnishing to the respective areas of the Property electric energy or other utility services, except water and sewer (including taxes or fuel adjustment or transfer charges and other like charges regularly passed on to the consumer by the public utility furnishing electric energy to the Property), payable by Tenant pursuant to clause (ii) below, and excluding any overtime charges for other tenants in the Building, and with Landlord having credited any sums paid as direct reimbursement of such costs by other tenants of the Building.

(ii) For and with respect to each calendar year of the Term (and any renewals or extensions thereof) including, without limit, the first calendar year during which the Term of this Lease shall have commenced, there shall accrue, as additional rent under this Lease and be paid within thirty (30) days after Tenant’s receipt from Landlord of a statement or statements of the amount due, Landlord’s costs in such calendar year of supplying such quantity of electric energy as is; (A) consumed by Tenant in the Premises, including, without limitation, such electric energy as is consumed by Tenant in connection with the operation of the heating, ventilating and air-conditioning systems serving only the Premises, if any, as such consumption shall have been shown on the meters referred to in Article 16(a)(viii) of this Lease, together with any reasonable administrative costs incurred by Landlord by reason thereof, and (B) Tenant’s proportionate share, as defined in Article 4(c) of this Lease, of Landlord’s costs in such calendar year of supplying electric energy and other utility service (excluding water and sewer), as is supplied to all non-tenanted areas of the Property in connection with the operation of the Property.

(iii) The method and timing (but not more frequently than monthly) of billing such costs of Landlord shall be determined by Landlord, using reasonable accounting principles, it being understood that it is not intended that Landlord derive any profit from the supplying of electric energy or other utility service. At Landlord’s option, Landlord may bill Tenant for Tenant’s share of Tenant Energy Costs monthly on an estimated basis (which may be adjusted from time to time by Landlord) in advance with a reconciliation of such costs to be made on an annual basis. Tenant shall have the right to audit Tenant Energy Costs on the same basis as Tenant may audit Annual Operating Costs.

(iv) If Tenant shall fail to pay when due any amounts payable by Tenant under this Article 4(d), and such failure shall continue for ten (10) days after Tenant’s receipt of written notice from Landlord, then in addition to any other rights and remedies available to Landlord under this Lease, or at law or in equity, Landlord may terminate any utility services to the Premises furnished by Landlord for which payment is overdue, without any liability to Tenant, whether for interruption of Tenant’s business or otherwise.

(e) Annual Operating Costs.

(i) The term “Annual Operating Costs” shall mean the actual costs to Landlord of operating and maintaining the Property (including, without limit, all improvements thereto and fixtures and equipment therein or thereon) during each calendar year of the Term

5

(and any renewals or extensions thereof) including, without limit, the first calendar year during which the Term of this Lease shall have commenced, excluding Tenant Energy Costs and Annual Tax Costs. Such costs shall include, by way of example rather than of limitation, (1) charges or fees for, and taxes on, the furnishing to the Property of water and sewer service, electric energy (excluding the supply of electric energy included in Tenant Energy Costs) and, if the Building systems should be converted to receive the same, steam or fuel and other utility services; (2) costs of elevator service and charges or fees for maintenance of the Property, planting, replanting and janitorial service, trash removal, policing, cleaning, restriping, resurfacing, maintaining and repairing all walkways, roadways, parking areas forming part of the Property, maintaining all landscaped areas of the Property; (3) charges or fees for any necessary governmental permits; (4) wages, salaries and benefits of employees of Landlord who perform duties connected with the operation, maintenance and repair of the Property (to the extent such employees or persons are directly engaged in the repair, operation and maintenance of the Property, are commercially reasonable, and such expenses are not allocated to a leasing agent), management fees (which is a fee separate from the aforementioned expenses for wages, salaries and benefits of employees of Landlord performing duties for the Property, not to exceed five percent (5%) of annual gross rental revenue for the Building), overhead and expenses, provided, that in no event shall Annual Operating Costs for purposes of this Lease include wages, salaries and/or benefits attributable to Building management personnel above the level of the general manager or equivalent; (5) the cost of premiums for hazard, rent, liability, workmen’s compensation and other insurance upon the Property or portions thereof; (6) costs arising under service contracts with independent contractors servicing or performing maintenance or other related tasks for the Building; (7) professional and consulting fees including, without limit, legal and auditing fees; (8) repairs, replacements and improvements to the Property which are reasonable and necessary for the continued operation of the Building as a first class office building; and (9) the cost of all other items which, under standard accounting practices, constitute operating or maintenance costs which are attributable to the Property or any portion thereof. Notwithstanding the foregoing, the term “Annual Operating Costs” shall not include: depreciation on the Building or equipment; interest and principal payments on mortgage encumbrances and other debt costs; ground rents; income taxes; salaries of executive officers of Landlord; costs incurred in connection with leasing space, including broker’s leasing commissions or compensation, advertising and other marketing expenses, and legal, space planning, construction, and other expenses incurred in procuring tenants for the Building or renewing or amending leases with existing tenants or occupants of the Building; expenditures for capital improvements, except (1) capital expenditures made primarily for the purpose of reducing operating expense costs or otherwise improving the operating efficiency of the Building and (2) capital expenditures required by law which become effective after the Commencement Date, in either of which cases the cost thereof shall be included in Annual Operating Costs for the calendar year in which the cost shall have been incurred and subsequent calendar years, on a straight line basis, to the extent that such items are amortized over an appropriate period, but not more than ten (10) years, with an interest factor equal to two percent (2%) plus the prime rate (as hereinafter defined) at the time Landlord shall have incurred said costs; costs of other services or work performed for the benefit of other tenants or occupants if the same or similar services are not available to Tenant; any expense for which Landlord actually receives reimbursement from insurance, condemnation awards, other tenants (other than through the payment of additional Annual Operating Costs under such tenants’ leases) or any other source; costs incurred in connection with the sale, financing, refinancing, mortgaging, or other change of ownership of the Property or any interest therein; Annual Tax Costs; costs incurred due to a breach by Landlord or

6

any other tenant of the terms and conditions of any lease; costs of remediating any environmental condition which violates any applicable law; the amount, if any, by which sums paid to entities related to the Landlord for various items and/or services supplied to the Property exceed the cost, if obtained on a competitive basis, of similar items and/or services in the area; management fees in excess of those which are commercially reasonable for comparable properties in the relevant market; costs incurred by Landlord in connection with construction of the Building and related facilities or the correction of latent defects in construction of the Building; expenses resulting from the gross negligence or willful misconduct of Landlord or its agents, employees or contractors; any costs for Landlord’s failure to comply with applicable legal requirements; and costs or expenses that are properly chargeable to particular tenants in the Building, including, without limitation, costs and expenses for damages to the Building or any part thereof caused by the act or neglect of another tenant. As used in this Lease, “the prime rate” shall mean the rate of interest per annum announced from time to time by Wells Fargo Bank, N.A. or its successor as its prime lending rate (or if such prime lending rate is discontinued, such comparable rate as Landlord reasonably designates by notice to Tenant).

(ii) If Landlord shall have purchased any item of capital equipment or shall have made any capital expenditure designed to result in savings or reductions in Annual Operating Costs or Tenant Energy Costs applicable to leased space generally, then the costs of having purchased such equipment and such capital expenditures shall be included in Annual Operating Costs for the calendar year in which the costs shall have been incurred and subsequent calendar years, on a straight line basis, to the extent that such items are amortized over such period of time as reasonably can be estimated as the time in which such savings or reductions in Annual Operating Costs are expected to equal Landlord’s costs for such capital equipment or capital expenditure, with an interest factor equal to the prime rate at the time of Landlord’s having incurred said costs. If Landlord shall have leased any such items of capital equipment designed to result in savings or reductions in Annual Operating Costs, then the rental and other costs paid pursuant to such leasing shall be included in Annual Operating Costs for the calendar year in which they shall have been incurred.

(iii) The term “Base Operating Costs” shall mean the Annual Operating Costs incurred by Landlord during the calendar year 2017. Base Operating Costs shall be calculated based on routine and recurring operations of the Property and shall not include any non-recurring operating costs or repairs related to deferred maintenance which occur less often than once every five (5) years.

(iv) For and with respect to each calendar year of the Term (and any renewals or extensions thereof) excluding, however, the first calendar year during which the Term of this Lease shall have commenced, there shall accrue, as additional rent hereunder, and be paid within thirty (30) days after Tenant’s receipt from Landlord of a statement or statements of the amount due, Tenant’s proportionate share of the increase, if any, of Annual Operating Costs over Base Operating Costs.

(v) Anything contained in the foregoing provisions of this Article 4 to the contrary notwithstanding, in any instance in which the Tenant shall have agreed in this Lease or otherwise to provide any item or items of Annual Operating Costs partially or entirely at its own expense, in calculating and allocating increases in Annual Operating Costs over Base Operating Costs pursuant to the foregoing provisions of this subsection, Landlord shall make

7

appropriate adjustments, using reasonable accounting principles, so as to avoid allocating to the Tenant the same such item or items of the Base Operating Costs and Annual Operating Costs (partially or entirely, as aforesaid) being provided to other tenants by Landlord at Landlord’s expense. Subject to the preceding sentence, if during all or part of any calendar year, Landlord shall not furnish any item or items of Annual Operating Costs to any portions of the Building because such portions are not occupied or because such item is not required or desired by the tenant of such portion or such tenant is itself obtaining and providing such item or for other reasons, then, for the purposes of computing the additional rent payable hereunder, the amount of Annual Operating Costs for such period (including without limitation in connection with the calculation of Base Operating Costs) shall be deemed to be increased by an amount equal to the additional costs which would normally have been incurred during such period by Landlord if it had at its own expense furnished such item to such portion of the Building.

(f) Annual Tax Costs.

(i) The term “Annual Tax Costs” shall mean all real estate taxes and assessments, general or special, ordinary or extraordinary, foreseen or unforeseen (including “Lease Taxes” as defined in Article 4(j) of this Lease) assessed or imposed upon the Property at the discounted amount (provided that Landlord pays within the discount period, otherwise such amount shall be calculated based upon the undiscounted amount), plus the expenses of any contests (administrative or otherwise) of tax assessments or proceedings to reduce taxes, including reasonable attorneys’ and appraisers’ fees, incurred each calendar year during the Term (and any renewals or extensions thereof) including, without limit, the first calendar year during which the Term of this Lease shall have commenced; provided however, that except as set forth in the next sentence, there shall be excluded from Taxes all income taxes, excess profit taxes, excise taxes, franchise taxes, estate, succession, inheritance and transfer taxes. If, due to a future change in the method of taxation, any franchise, income, profit or other tax, however designated, shall be levied or imposed in substitution, in whole or in part, for (or in lieu of) any tax or addition or increase in any tax which would otherwise be included within the definition of Taxes, such other tax shall be deemed to be included within Taxes as defined in this Lease. For all purposes under this Lease, “Annual Tax Costs” shall not include (1) penalties, fines or interest incurred as a result of Landlord’s inability or failure to make payment of Annual Tax Costs (unless directly caused by Tenant) and/or to file any tax or informational returns when due, or from Landlord’s failure to make any payment of Annual Tax Costs required to be made by Landlord hereunder before delinquency, (2) taxes to be paid directly by Tenant, whether or not actually paid, and (3) transfer or other taxes incurred in the sale, financing or refinancing of the Premises or the Building. Tax refunds shall be credited against Annual Tax Costs and promptly refunded to Tenant regardless of when received, based on the year to which the refund is applicable.

(ii) The term “Base Tax Costs” shall mean the Annual Tax Costs incurred by Landlord during the calendar year 2017 (excluding the expenses of any contests (administrative or otherwise) of tax assessments or proceedings to reduce Annual Tax Costs, including attorneys’ and appraisers’ fees incurred in the calendar year 2017). If Base Tax Costs are subsequently reduced by an assessment appeal or otherwise, then Landlord shall retroactively reduce Base Tax Costs for purposes of determining additional rent; provided, however, that any such reduction shall be made and written notice thereof given to Tenant no later than the date

8

that is five (5) years after the last calendar day of the calendar year for which the reduction is made.

(iii) For and with respect to each calendar year of the Term (and any renewals or extensions thereof) excluding, however, the first calendar year during which the Term of this Lease shall have commenced, there shall accrue, as additional rent hereunder, and be paid within fifteen (15) days after Landlord shall have given to Tenant a statement or statements of the amount due, Tenant’s proportionate share of the increase, if any, of Annual Tax Costs over Base Tax Costs.

(g) Partial Year. If only part of any calendar year shall fall within the Term, the amount computed as additional rent with respect to such calendar year shall be prorated in proportion to the portion of such calendar year falling within the Term (but the expiration or termination of the Term prior to the end of such calendar year shall not impair the Tenant’s obligation under this Lease to pay such prorated portion of such additional rent with respect to that portion of such year falling within the Term, which shall be paid within thirty (30) days after Tenant’s receipt of a statement or statements of the amount due.

(h) Payment of Estimated Increase. Anything in this Lease to the contrary notwithstanding, the Landlord shall be entitled to make from time to time during the Term, a reasonable estimate of the amount of Tenant’s proportionate share of the increase, if any, of Annual Operating Costs over Base Operating Costs and Tenant’s proportionate share of the increase, if any, of Taxes over Base Tax Costs which may become due under this Lease with respect to any calendar year and to require the Tenant to pay to the Landlord, at the time and in the manner in which the Tenant is required under this Lease to pay the monthly installment of the Fixed Rent with respect to such month, with respect to each calendar month during any such calendar year, one-twelfth (1/12) of the amount which Landlord shall have estimated will become payable on account of increases in Annual Operating Costs and Annual Tax Costs. In such event, Landlord shall cause the actual amount of the additional rent to be computed and a statement thereof and of Base Operating Costs and Base Tax Costs to be sent to the Tenant within one hundred twenty (120) days following the end of the calendar year (including the last calendar year of the Term); the Tenant or the Landlord, as the case may be, shall, within thirty (30) days after such statement is received by Tenant, pay to the other the amount of any deficiency or overpayment, respectively, therein.

(i) Disputes. Any statement furnished to Tenant by Landlord under the preceding paragraph or other provisions of this Article shall constitute a final determination as between Landlord and Tenant of the additional rent due from Tenant for the period represented thereby unless Tenant, within sixty (60) days after a statement is furnished, shall have given a notice to Landlord that Tenant disputes the correctness of the statement, specifying in reasonable detail the basis for such assertion (the “Audit”). Pending resolution of such a dispute, Tenant shall pay the additional rent in accordance with the statement furnished by Landlord. Landlord agrees, upon prior written request, during normal business hours to make available for inspection by an independent certified public accountant, not compensated on a contingency basis, at Landlord’s offices, Landlord’s books and records which are relevant to any items in dispute. If, after the Audit, Tenant disagrees with Landlord’s calculation of such costs, Tenant shall, within thirty (30) days of completion of the Audit (but not later than one hundred fifty (150) days of Tenant’s receipt of Landlord’s Statement) so advise Landlord in writing and shall specify the

9

reason for such disagreement. If Landlord and Tenant are unable to resolve such disagreement in good faith within thirty (30) days of Landlord’s receipt of such notice, Landlord and Tenant shall select a mutually agreeable certified public accountant (the “Expert”), who will review all information supplied to and by Tenant in connection with said disputed item(s) and determine the amount of the overpayment, if any. The findings of such Expert shall be binding on both parties and not subject to appeal. If the Expert determines that Tenant’s ultimate liability for Annual Operating Cost and, Annual Tax Costs does not equal the aggregate amount actually paid by Tenant to Landlord during the period which is the subject of the Audit, the appropriate adjustment shall be made between Landlord and Tenant, and any payment required to be made by Landlord or Tenant to the other shall be made within thirty (30) days after the Expert’s final, written determination. If the Expert determines that there is an overcharge for any twelve month period of more than 5% of the amount invoiced by Landlord for such period, Landlord shall pay the costs of the Expert. Before conducting the Audit, Tenant must pay the full amount of Tenant’s Proportionate Share of Annual Operating Costs and Annual Tax Costs then in question. In no event shall this Lease be terminable nor shall Landlord be liable for damages based upon any disagreement regarding an adjustment of Annual Operating Costs, except as otherwise expressly set forth in this subsection (i). Tenant agrees that the results of any audit shall be kept strictly confidential by Tenant and shall not be disclosed to any nonaffiliated person or entity.

(j) Lease Tax. If federal, state or local law now or hereafter imposes any tax, assessment, levy or other charge (other than any income tax) directly or indirectly upon the Landlord with respect to this Lease or the value thereof, or upon the Tenant’s use or occupancy of the Premises, or upon the rent, additional rent or any other sums payable under this Lease or upon this transaction, except if and to the extent that the same are included in the Annual Tax Costs (all of which are herein called “Lease Taxes”) the Tenant shall pay to the Landlord, as additional rent hereunder and upon demand, the amount of such tax, assessment, levy or other charge, unless the Tenant shall be prohibited by law from paying such tax, assessment levy or other charge, in which event the Landlord shall be entitled, at its election, to terminate this Lease, to be effective no sooner than twelve (12) months thereafter, by written notice to the Tenant delivered no later than six (6) months after the effectiveness of such change in the tax laws.

5. Covenant to Pay Rent and Additional Rent; Late Charge.

Tenant shall, without prior demand, notice, setoff or deduction (except as otherwise expressly set forth in this Lease), pay the Fixed Rent and all other sums which may become due and payable by Tenant under this Lease, at the times, at the places and in the manner provided in this Lease. All such other sums shall be payable as additional rent for all purposes whether or not they would otherwise be considered rent. If any payment or any part thereof to be made by Tenant to Landlord pursuant to the terms of this Lease shall have become overdue for a period in excess of ten (10) days, a late charge of five cents ($.05) for each dollar so overdue may be charged by Landlord for the purpose of defraying the expense incident to handling such delinquent payment, together with interest from the date when such payment or part thereof was due at the Lease Interest Rate (defined below) or such lesser amount or rate, if any, as represents the maximum amount or rate Landlord lawfully may charge in respect of Tenant in such circumstances. Nothing herein shall be construed as waiving any rights of Landlord arising out of any uncured defaults of Tenant (following applicable notice and cure periods) by reason of Landlord’s assessing or accepting any such late payment, the late charge and interest provided herein is separate and apart from any rights relating to remedies of the Landlord after uncured

10

default (following applicable notice and cure periods) by Tenant in the performance or observance of the terms of this Lease. Without limiting the generality of the foregoing, if an uncured Event of Default exists, Landlord may (but shall not be obligated to do so), in addition to any other rights it may have in law or equity, cure such default on behalf of Tenant and Tenant shall reimburse Landlord upon demand for any sums paid or costs reasonably incurred by Landlord in curing such default, including interest thereon at the Lease Interest Rate or such lesser rate as represents the maximum rate Landlord lawfully may charge in respect of Tenant in such circumstances, reasonable attorney’s fees and other legal expenses, including also the said late charge and interest on all sums paid and costs reasonably incurred by Landlord as aforesaid, which sums and costs together with late charge and interest thereon shall be deemed additional rent hereunder. As used in this Lease, the “Lease Interest Rate” shall mean four percent (4%) plus the prime rate.

6. Use.

The Premises are to be used only by Tenant for general office purposes, as well as a light laboratory/research on the first floor Premises, if applicable, and for other legally permitted uses incidental thereto. Tenant shall not use or occupy the Premises or any part thereof, or permit the Premises or any part thereof to be used or occupied, other than as specified in the sentence immediately preceding. Tenant shall permit its employees, invitees and guests to park only automobiles, or similarly sized vehicles, on the Property. Such parking shall be provided at a rate of 3.7 spaces/1,000 rsf and shall be unreserved and be limited to Tenant’s proportionate share of the Building.

7. Assignment and Subletting.

(a) The Tenant shall not mortgage, pledge or encumber this Lease. Except in connection with a Permitted Transfer (as hereinafter defined), the Tenant shall not assign this Lease or sublet or underlet the Premises or any part thereof, or permit any other person or entity to occupy the Premises or any part thereof, without on each occasion first obtaining the written consent thereto of the Landlord. An assignment within the meaning of this Lease is intended to comprehend not only the voluntary action of Tenant, but also any levy or sale on execution or other legal process against Tenant’s goods or other property of the leasehold, and every assignment of assets for the benefit of creditors, and the filing of any petition or order or any adjudication in bankruptcy or under any insolvency, reorganization or other voluntary or compulsory procedure, and the calling of a meeting of creditors, and the filing by or against Tenant of any petition or notice for a composition with creditors, and any assignment by operation of law. For purposes of the foregoing, a transfer, by any person or persons controlling the Tenant on the date hereof, of such control to a person or persons not controlling the Tenant on the date hereof shall be deemed to be an assignment of this Lease; provided however, the foregoing shall not apply to any transfers of interests that are traded on a national exchange.

(b) Except in connection with a Permitted Transfer, if Tenant proposes to assign this Lease or sublet all or any portion of the Premises, Tenant shall, prior to the proposed effective date thereof (the “Effective Date”), deliver to Landlord a copy of the proposed agreement and all ancillary agreements with the proposed assignee or subtenant, as applicable. Landlord shall then have all the following rights, any of which Landlord may exercise by written

11

notice to Tenant given within thirty (30) days after Landlord receives the foregoing documents (a “Landlord Notice”):

(i) With respect to a proposed assignment of this Lease, the right to terminate this Lease on the Effective Date as if it were the Expiration Date, upon which termination all of Tenant’s obligations under this Lease shall expire; provided, however, Tenant shall have the right, by written notice to Landlord given within five (5) days after the date of Tenant’s receipt of the Landlord Notice, to rescind its request for consent to an assignment, in which event the Lease shall continue in full force and effect;

(ii) With respect to a proposed subletting of the entire Premises, the right to terminate this Lease on the Effective Date as if it were the Expiration Date, upon which termination all of Tenant’s obligations under this Lease shall expire; provided, however, Tenant shall have the right, by written notice to Landlord given within five (5) days after the date of Tenant’s receipt of the Landlord Notice, to rescind its request for consent to a sublease, in which event the Lease shall continue in full force and effect;

(iii) With respect to a proposed subletting of 50% or more of the area of the Premises, the right to terminate this Lease as to the portion of the Premises affected by such subletting on the Effective Date, as if it were the Expiration Date, in which case Tenant shall promptly execute and deliver to Landlord an appropriate modification of this Lease in form satisfactory to Landlord in all respects; provided, however, Tenant shall have the right, by written notice to Landlord given within five (5) days after the date of Tenant’s receipt of the Landlord Notice, to rescind its request for consent to a proposed sublease, in which event the Lease shall continue in full force and effect; or

(iv) Landlord may consent to the proposed assignment or sublease on such terms and conditions as Landlord may reasonably require, including without limitation, the execution and delivery to Landlord by the assignee of an assumption of liability agreement in form reasonably satisfactory to Landlord, including an assumption by the assignee of all of the obligations of Tenant and the assignee’s ratification of an agreement to be bound by all of the provisions of this Lease, including the warrants of attorney to confess judgment in assumpsit and in ejectment; or, in the case of a sublease, the execution and delivery by the subtenant of a written agreement with Landlord, in such form and with such terms, covenants and conditions as may be reasonably required by Landlord; or

(v) Landlord may withhold its consent to the proposed assignment or sublease, provided, however, that if Landlord declines to exercise one of the options set forth in items (i) through (iii) above, that Landlord will not unreasonably withhold its consent so long as the identity, reputation and financial strength of the proposed assignee or subtenant, and the proposed use of the Premises, are reasonably acceptable to Landlord; provided further, however, that Landlord shall in no event be required to consent to any sublease of space for rent and other charges less than those that the sublessor is required to pay or any assignment or subletting to a proposed assignee or subtenant that is (w) a government or any subdivision, agency or instrumentality thereof, (x) a school, college, university or educational institution of any type (whether for profit or non-profit), (y) an employment, recruitment or temporary help, service or agency or (z) another tenant of Landlord in Chesterbrook Corporate Center® or Glenhardie

12

Corporate Center® if Landlord has suitable space available for rent in Chesterbrook Corporate Center® or Glenhardie Corporate Center®.

(vi) In the event that Landlord does consent to the assignment or subletting, Tenant shall have ninety (90) days from its receipt of Landlord’s notice thereof to enter into the proposed sublease or assignment with the prospective subtenant or assignee described in Tenant’s notice to Landlord. If such sublease or assignment has not been executed within such time period and with such identified assignee or subtenant, the consent given by Landlord shall be considered to have been withdrawn.

(c) No assignment or sublease, whether with or without the Landlord’s consent, shall in any way relieve or release the Tenant from liability for the performance of all terms, covenants and conditions of this Lease.

(d) Except in the event of a Permitted Transfer, in the event of any sublease or assignment by Tenant of its interest in the Premises or this Lease or any portion thereof, whether or not consented to by Landlord, each monthly installment of Fixed Rent payable hereunder with respect to the Premises or the portion thereof subject to such subletting or assignment shall be increased by an amount equal to (i) in the case of any subletting, the Excess Rent (defined below) for such portion; and, in the case of any assignment, the Excess Rent payable by the assignee as amortized on a monthly basis over the remaining Term of this Lease with interest at the Lease Interest Rate (defined at Article 5 hereof). As used herein, “Excess Rent” shall mean a sum equal to fifty percent (50%) of the amount by which the rent and other charges or other consideration paid to Tenant by any subtenant or assignee exceeds the pro rata portion, for each month of such subletting or assignment, of the Fixed Rent and additional rent for such space then payable for such month by Tenant to Landlord pursuant to the provisions of this Lease in the absence of this subsection (d), less the portion applicable to such month, when amortized from the dates incurred over the remaining term of the sublease or assignment, of Tenant’s cost of improvements made or paid for by Tenant to satisfy the needs of the subtenant, and legal fees, leasing commissions and similar capital costs incurred by Tenant in connection with the assignment or subletting.

(e) If, pursuant to the exercise of the Landlord’s option in 7(b)(iii) above, this Lease terminates as to only a portion of the Premises, the Fixed Rent and Tenant’s Proportionate Share for the additional rent shall be adjusted in proportion to the portion of the Premises affected by such termination, as determined by Landlord; and Tenant, within thirty (30) days after Tenant’s receipt of written demand therefor and any supporting documentation reasonably requested by Tenant, shall pay to Landlord Landlord’s actual documented cost of any alterations necessary to separate such portion of the Premises from the remainder of the Premises plus three percent (3%) for Landlord’s overhead.

(f) If Landlord exercises any of its options under section 7(b)(i), (ii) or (iii), Landlord may then lease the Premises or any portion thereof to Tenant’s proposed assignee or subtenant, as the case may be, without liability whatsoever to Tenant.

(g) In the event Landlord fails to respond to any request for consent to an assignment, sublease or other transfer within ten (10) business days, Tenant shall have the right to provide Landlord with a second request for consent to such assignment, sublease or other

13

transfer. If Landlord’s failure to respond continues for five (5) business days after its receipt of such second request for consent, the assignment, sublease or other transfer for which Landlord has submitted a request for consent shall be deemed to have been consented to by Landlord. Tenant’s second request for consent must specifically state that Landlord’s failure to respond within a period of five (5) business days shall result in the subject assignment, sublease or other transfer being deemed to have been consented to by Landlord.

(h) In addition to, and not in lieu of, any other rights and remedies available to Landlord therefor, Landlord shall have the right to terminate this Lease if Tenant assigns or underlet the Premises without first obtaining Landlord’s written consent in violation of this Lease. In the event that Landlord exercises said right to terminate, said termination shall become effective on the date set forth in Landlord’s written notice.

(i) Tenant shall pay Landlord, as additional rent, a reimbursement for all reasonable and actual expenses incurred by Landlord, including counsel fees, in connection with Landlord’s review of any subletting or assignment request from Tenant, irrespective of Landlord’s election to approve or deny such request, not to exceed $2,500 per occurrence.

(j) Notwithstanding the foregoing, Tenant may assign its entire interest under this Lease or sublet the Premises (i) to any entity controlling or controlled by or under common control with Tenant or (ii) to any successor to Tenant by purchase, merger, consolidation or reorganization (hereinafter, collectively, referred to as “Permitted Transfer”) without the consent of Landlord, provided: (1) no Event of Default exists; (2) if such proposed transferee is a successor to Tenant by purchase, said proposed transferee shall acquire all or substantially all of the stock or assets of Tenant’s business or, if such proposed transferee is a successor to Tenant by merger, consolidation or reorganization, the continuing or surviving entity shall own all or substantially all of the assets of Tenant; and (3) with respect to a Permitted Transfer to a proposed transferee described in clause (ii), such proposed transferee shall have a net worth which is at least equal to Tenant’s net worth immediately preceding the execution of this Lease.

8. Condition of Premises; Improvement of the Premises.

(a) Except as otherwise expressly set forth herein, the Premises is leased to Tenant in its current AS-IS, WHERE-IS CONDITION; provided that Landlord shall, at Landlord’s sole cost and expense using Building standard finishes, complete the renovation of the bathrooms and common areas (hallway carpeting) on the second floor of the Building (matching, as near as practicable, standards existing on the first floor of the Building and in compliance with all applicable building codes and regulations) prior to the Commencement Date (collectively, the “Base Building Work”).

(b) Tenant Improvements.

(i) Construction of Tenant Improvements. Tenant will have plans for improvements to the Premises designed and approved in accordance with Section 8(b)(ii) (the “Tenant Improvements”) and constructed by Landlord as construction manager in accordance with Sections 8(b)(iii) and (iv).

(ii) Tenant Improvement Plans. Tenant’s specifications and plans for the Tenant Improvements shall be prepared by Tenant’s architect and provided to Landlord not

14

later than January 30, 2017, and Landlord’s approval or denial of such plans to be communicated to Tenant within ten (10) business days of such delivery. The tenant improvement plans will be prepared in commercially reasonable sufficient detail to permit Tenant or Landlord to construct the Tenant Improvements, and shall include partition layout (dimensioned), door location and door schedule including hardware, reflected ceiling plan, telephone and electrical outlets with locations (dimensioned), special electrical, HVAC and/or plumbing work, mechanicals, special loading requirements, such as the location of file cabinets and special equipment, openings in the walls or floors, all necessary sections and details for special equipment and fixtures, furniture layout and finishes including, without limitation, carpentry and millwork, floor coverings, wall coverings, color schedules, and any other special finishes. The tenant improvement plans shall be prepared in accordance with applicable laws and code requirements. Landlord shall not unreasonably withhold, condition or delay its approval of the tenant improvement plans. Any comments or suggested changes of Landlord shall be in writing and may be noted on the applicable drawings and plans provided they are legible and sufficiently detailed as warranted under the circumstances, including specific references and notations on applicable drawings and plans to highlight areas in which changes are requested. Tenant shall respond to any comments or suggested changes within five (5) business days of receipt from Landlord. Any comments or suggested changes of Tenant shall be in writing and may be noted on the applicable drawings and plans provided they are legible and sufficiently detailed as warranted under the circumstances, including specific references and notations on applicable drawings and plans to highlight areas in which changes are requested. Landlord shall then have five (5) business days to approve or deny such plans. This procedure shall be repeated with the parties working in good faith to resolve any differences until the Tenant construction plans are finally approved by Landlord and written approval has been delivered to and received by Tenant. A “Tenant Review Day” is any full business day during which the tenant improvement plans awaits review, approval, and/or comments from Tenant following Landlord’s submission to Tenant for review. After the eleventh (11th) total Tenant Review Day, each such subsequent Tenant Review Day shall constitute a Tenant Delay. Upon approval by Landlord, the tenant improvement plans shall become final and shall not be changed except as set forth herein and without Landlord’s and Tenant’s further approval, which shall not be unreasonably withheld, conditioned or delayed (as finally approved, the “Tenant Improvement Plans”). Upon approval of the Tenant Improvement Plans, Landlord shall specify those Tenant Improvements (including laboratory improvements) which Tenant must remove from the Premises upon termination of the Lease.

(iii) Changes to Plans. Tenant shall be permitted from time to time to direct changes in the Tenant Improvement Plans after the approval of the Tenant Improvement Plans in accordance with the procedures set forth herein.

(A) Any request for any changes to the Tenant Improvement Plans by Tenant must be presented by Tenant to Landlord and its general contractor in writing (each, a “Change Order Request”). Within five (5) business days of its receipt of any Change Order Request, (1) Landlord and/or its general contractor shall prepare a written proposal of the cost and time impacts to implement the Change Order Request (“Price/Time Adjustment”), or (2) if Landlord and/or the General Contractor reasonably believes that the Change Order Request does not comply with the applicable laws, Lease, applicable regulations or the insurance requirements, or Landlord does not approve the Change Order Request on some other basis, Landlord and/or its general contractor shall request revisions or modifications thereto.

15

(B) If the Landlord and its general contractor have reviewed the Change Order Request and responded with the Price/Time Adjustment proposal for the Change Order Request, the Tenant shall expeditiously (within two (2) business days) respond as to its acceptance or rejection of the Price/Time Adjustment. Tenant’s failure to timely respond shall be deemed a rejection of the Price/Time Adjustment.

(C) If the Landlord requests revisions or modifications pursuant to this Article and the Tenant wishes to proceed with the Change Order Request, then Tenant shall submit such revisions or modifications within two (2) business days after its receipt of such request from Landlord or its general contractor. Within five (5) business days following receipt by Landlord and its general contractor of such revisions or modifications, Landlord and its general contractor shall review such modifications and shall give its written response thereto, including any Price/Time Adjustment, or shall request other revisions or modifications thereon. The preceding two sentences shall be implemented repeatedly until Landlord and its general contractor and Tenant give written approval to the Change Order Request or Tenant withdraws the Change Order Request. An approved Change Order Request shall be referred to as a Change Order once approved by the Tenant, Landlord and its general contractor.

(D) For any Change Order for which Tenant accepted the Price/Time Adjustment set forth herein, the final Price/Time Adjustment shall be equal to the amount and time so set forth and will be binding on Landlord, General Contractor and Tenant, and any Price/Time Adjustment resulting from a Change Order shall increase the general contract lump sum and/or Project schedule.

(iv) Completion by Landlord as Construction Manager. Landlord as construction manager will solicit competitive bids for the construction of the Tenant Improvements from the following contractors and Landlord will enter into a construction contract with one of such contractors as determined by Landlord in its sole discretion, but after consultation from Tenant: McLucas; Shields; LK Miller; and HSC Builders. The construction contract entered into with the selected general contractor shall be at a fixed, lump sum amount, and shall also include a detailed schedule for construction of the Tenant Improvements acceptable to Landlord and Tenant. Landlord shall be paid an administrative and construction management fee for Landlord’s supervision of such construction in an amount equal to $41, 750.00 (the “Project Management Fee”), which management fee shall remain fixed and not subject to change for the project except for increases equal to two percent (2%) of the net cost increase or decrease resulting from any Change Order. Landlord shall ensure that the general contractor (1) is qualified and licensed (as necessary); (2) is fully competent to timely and properly perform the services or work to be performed; (3) will be engaged under industry standard terms and conditions (including warranties, payment procedures, indemnity, Change Orders, waiver of liens, schedule of values, etc., but excluding bonding) and at industry compatible rates; (4) will comply in all respect to the requirements of this Lease and the Tenant Improvement Plans; and (5) will carry and maintain appropriate commercial general liability and other insurance satisfactory to Landlord.

(v) Delay in Substantial Completion of the Tenant Improvements. Landlord shall use good faith diligent efforts to cause the Tenant Improvements to be Substantially Completed not later than July 1, 2017, subject to force majeure and Tenant Delays. If the Premises are not delivered to Tenant with the Tenant Improvements Substantially

16

Completed by August 29, 2017, Tenant will receive a credit against Fixed Rent for each day from August 15, 2017, as such date is extended for each day of force majeure and Tenant Delay occurring from the date of this Lease, until the date of Substantial Completion (as extended, the “Rent Credit Date”).

(vi) Tenant Delay. For purposes of determining the date when the Premises are ready for occupancy (and, correspondingly, the date of Substantial Completion of the Tenant Improvements, the Commencement Date and the Rent Credit Date), there shall not be considered the duration of any delay (“Tenant Delay”) which is caused by:

(A) changes in the work to be performed by Landlord in readying the Premises for Tenant’s occupancy, which changes shall have been requested by Tenant after the approval by Landlord and Tenant of the Tenant Improvement Plans;

(B) delays, not caused by Landlord, in furnishing materials or procuring labor required by Tenant for installations or work in the Premises including but not limited to laboratory components of the Tenant Improvements;

(C) any failure by Tenant to furnish any required plan, information, approval or consent within the required period of time (including, without limit, delivery of the Tenant Improvement Plans not later than January 30, 2017); or

(D) the performance of any work or activity in the Premises by Tenant or any of its employees, agents or contractors.

The Tenant Improvements shall be deemed Substantially Complete and the Commencement Date shall occur on the date the Premises would have been ready for occupancy but for the causes described in this subparagraph.

(vii) Construction Standards, Punchlist, Substantial Completion. All construction shall be done in a good and workmanlike manner, shall be free from defects and deficiencies, shall comply at the time of completion with all applicable laws and requirements of the governmental authorities having jurisdiction, and shall be in accordance with the Tenant Improvement Plans. Tenant shall have the right to inspect the Tenant Improvements at all reasonable times during business hours upon written notice and request to Landlord, provided however, Tenant shall not destroy or damage any such work in place, and that Tenant’s failure to inspect the Tenant Improvements shall in no event constitute a waiver of any of Tenant’s rights hereunder nor shall Tenant’s inspection of the Tenant Improvements constitute Tenant’s approval of the same. Tenant may attend construction project meetings and, in connection with its monitoring of the construction, will be provided with copies of meeting minutes, payment applications and payments, schedules, inspection reports, punchlists, and other construction records upon their distribution. Landlord shall provide a certificate of occupancy to Tenant upon Substantial Completion of the work. However, prior to the Premises being delivered to Tenant and the commencement of the Term, a representative of Landlord and a representative of Tenant shall walk through the Premises and jointly prepare a list of items which, in the mutual opinion of Landlord and Tenant, have not been fully completed or which require repair by the general contractor (the “Punchlist Items”), which list may be supplemented jointly by Landlord and Tenant. Landlord shall use reasonable commercial efforts to cause the general contractor to

17

complete or repair the Punchlist Items within thirty (30) days after the date of the “walk-through,” or, if such Punchlist Items cannot reasonably be completed or repaired within thirty (30) days, shall use commercially reasonable efforts to complete or repair such items as quickly as possible and at minimal interruption to Tenant. For purposes of this Lease, “Substantial Completion” of the Tenant Improvements shall be the date all of the following conditions are satisfied, or an earlier date by which such conditions would have been satisfied but for delays caused solely by Tenant, including but not limited to any delay in providing Tenant’s specifications and plans for the Tenant Improvements and Tenant’s Change Orders: (1) Landlord notifies Tenant in writing that the general contractor has substantially completed the Tenant Improvements, leaving only Punchlist Items remaining; (2) Landlord provides to Tenant a certificate from Landlord’s engineer or general contractor attesting to such Substantial Completion in the customary form, and signed by Landlord; (3) a conditional or permanent certificate of occupancy has been issued by the applicable regulatory authority for the Premises as they relate to the Tenant Improvements that permits Tenant’s occupancy and use of the Premises for the purposes contemplated by the Lease; (4) the other portions of the building and the Premises, including the loading dock, are accessible to Tenant via the lobby, entranceways, elevators and hallways as permitted under the Lease; (5) the Premises are broom clean; and (6) the building systems (i.e., base building mechanical, electrical, life safety, plumbing, sprinkler systems and HVAC systems) are in good working order and repair.

(viii) Warranty. Landlord shall ensure that the general contract contains a warranty by the general contractor that when completed, the Tenant Improvements will be free and clear of material defects in workmanship and material for one year after Substantial Completion of the Tenant Improvements, and that general contractor will correct free of charge during this warranty period any material defect within thirty (30) days of its receipt of a notice from Landlord of such defect (with customary exceptions and exclusions for normal wear and tear, etc.); provided, however, that if a defect is of such a nature that the same cannot be corrected completely within said thirty (30) day period, then general contractor will commence correcting the defect within said thirty (30) day period and proceed diligently and in good faith to completely correct the defect. Landlord will use commercially reasonable efforts to cooperate with Tenant and to enforce such warranties upon notice of any claim by Tenant, or alternatively Landlord may assign such warranties to Tenant.

(ix) Tenant Improvement Costs. Tenant shall, subject to Section 8(b)(x) below, be responsible for and pay the costs, expenses and fees incurred for the construction of the Tenant Improvements, including without limitation (1) Tenant’s architectural, engineering and design costs associated with the Tenant Improvements, (2) the cost charged to Landlord or Tenant by the general contractor and all subcontractors for performing construction of the Tenant Improvement, (3) the cost to Landlord of directly performing any part of the construction of the Tenant Improvements, (4) the Project Management Fee, (5) construction permit fees, (6) costs of built-in furniture that is part of the Tenant Improvement Plans, (7) mechanical and structural engineering fees for the Tenant Improvements, and (8) Tenant’s cabling and costs of moving furniture and equipment into and within the Building (together, the “Tenant Improvement Costs”). Notwithstanding Tenant’s responsibility to Landlord for the Tenant Improvement Costs associated with the Landlord’s general contractor for work to construct the Tenant Improvements, Landlord shall be responsible for direct payments to its general contractor under the general contract with no recourse to Tenant.

18

(x) Tenant Allowance. Landlord shall provide an allowance to Tenant equal to $1,703,730.00 (the “Tenant Allowance”), which Tenant Allowance shall be applied by Landlord to the payment of the Tenant Improvements Costs; any remaining balance may be used by Tenant for any costs or expenses related to or arising from the design, construction, permitting, general conditions, management and inspection of the Tenant Improvements and tenant improvements for any Expansion Space (as defined in Section 40) but only if expended within 365 days from the Commencement Date defined in Section 3(a). In addition, and not as part of the Tenant Allowance, Landlord shall pay for the preparation of one test fit plan to be prepared by Tenant’s architect up to an amount of $3,903.68 (the “Test Fit Allowance”). Upon submission of an invoice evidencing completion of the test fit plan by Tenant’s architect, Landlord shall pay such architect an amount equal to the lesser of the invoiced amount or the Test Fit Allowance. Any excess payment required by the architect shall be paid by Tenant.

(xi) Payment for Tenant Improvement Costs. If there is a projected excess of Tenant Improvement Costs based upon the budget for the Tenant Improvements, Tenant agrees to prepay such projected excess to Landlord within ten (10) days of being billed therefor, even though such costs have not been incurred. Upon completion of the Tenant Improvements by Landlord, Tenant shall pay to Landlord all costs incurred in excess of the Tenant Allowance, which were not previously paid by Tenant to Landlord, or Landlord shall reimburse to Tenant any amount of the projected costs of the Tenant Improvements prepaid by Tenant to Landlord which were not actually expended by Landlord for the Tenant Improvements. The Tenant Allowance shall be released by Landlord as follows:

(c) Direct Tenant Work. Notwithstanding anything herein, Tenant’s furniture, security, telephone and data wiring and cabling (hereinafter called the “Direct Tenant Work”) shall be installed in accordance with the Tenant Improvement Plans by contractors contracting with Tenant and not with Landlord.

(d) Access; Acceptance of Work. Landlord shall afford Tenant and its employees, agents and contractors access to the Premises, at reasonable times prior to the Commencement Date and at Tenant’s sole risk and expense, in accordance with Exhibit “D” (“Early Access by Tenant”).

(e) Representations and Warranties. Landlord represents and warrants to Tenant that (i) the Building is not subject any covenants, encumbrances, conditions, restrictions, private agreements, reciprocal easement agreements or any other exceptions to title which prohibits or limits Tenant’s ability to use the Building and Premises for the purposes described in this Lease (collectively, the “Encumbrances”), (ii) the Property is not in violation of the Encumbrances; (iii) the Property (including the Building and Premises) is presently (and will be as of the Commencement Date) in compliance with all laws (including, but not limited to, the Americans with Disabilities Act), Encumbrances and fire underwriter’s requirements; (iv) there are no outstanding delinquent real estate taxes or assessment for the Building; (v) the Building is not subject to any pending, or, to Landlord’s knowledge threatened litigation; (vi) Landlord holds fee simple title to the Building; and (vii) the Premises are not leased and are not subject to any rights of first refusal, rights of first offer, options or other preferential rights to lease, occupy, license or purchase. Landlord makes no representations or warranties with respect to the zoning of the Premises or Tenant’s intended use of the Premises.

19

9. Alterations.

No alterations, additions or improvements (excluding cosmetic work, as set forth herein) shall be made to the Premises or any part thereof by or on behalf of Tenant without first submitting a detailed description thereof to Landlord and obtaining Landlord’s written approval. In the event Landlord fails to respond to any request for consent to an alteration within ten (10) business days, Landlord shall be deemed to have denied such requested alteration. Cosmetic work (such as painting and carpeting) is permitted without Landlord’s consent provided the same shall not exceed $50,000.00 in the aggregate in any twelve (12) month period. For any alterations, additions or improvements affecting structural portions of the Building or any Building systems, Landlord, at Landlord’s option, shall have the right to provide construction management for and on behalf of Tenant at Tenant’s sole expense constituting five percent (5%) of the alteration’s total cost. All alterations, additions or improvements made by Tenant and all fixtures attached to the Premises shall become the property of Landlord and remain at the Premises or, at Landlord’s option, after written notice to Tenant, any or all of the foregoing which may be designated by Landlord shall be removed at the cost of Tenant before the expiration or sooner termination of this Lease and in such event Tenant shall repair all damage to the Premises caused by the installation or removal; provided that Tenant may submit a written request to Landlord at the time of seeking Landlord’s approval for any alteration, addition or improvement requesting a determination by Landlord as to whether such alteration, addition or improvement will need to be removed at the expiration or sooner termination of the Lease in which event Landlord’s determination shall be shall be binding. Notwithstanding anything in this Lease, unless otherwise requested by Landlord in writing, Tenant shall remove all Direct Tenant Work (defined at Article 8(b) hereof) and shall repair all damage to the Premises caused by the installation or removal of such Direct Tenant Work. Except as set forth in Article 16(b)(viii), Tenant shall not erect or place, or cause or allow to be erected or placed, any sign, advertising matter, lettering, stand, booth, showcase or other article or matter in or upon the Premises and/or the building of which the Premises are a part, without the prior written consent of Landlord, not to be unreasonably withheld; provided however, Tenant may place such items within the Premises so long as not visible from the exterior of the Premises. Tenant shall not place weights anywhere beyond the safe carrying capacity of the structure.

10. Rules and Regulations.

The rules and regulations attached to this Lease as Exhibit “E”, and such additions or modifications thereof as may from time to time be made by Landlord upon written notice to Tenant, shall be deemed a part of this Lease, as conditions, with the same effect as though written herein, and Tenant also covenants that said rules and regulations will be faithfully observed by Tenant, Tenant’s employees, and all those visiting the Premises or claiming under Tenant. All such changes to rules and regulations will be reasonable and will be generally applicable to all tenants of the Building and shall be sent by Landlord to Tenant in writing. In the event of a conflict between the rules and regulations and the terms of this Lease, the terms of this Lease shall control. Landlord shall not knowingly enforce the rules and regulations against Tenant in a discriminatory manner.

20

11. Fire or Other Casualty.